Author: Jonathan Harrington

If you’re 65 or older, by now you should have received your annual installment of the official U.S. government Medicare handbook, Medicare & You 2022 . Your mailbox is also probably full of Medicare-related flyers from insurance companies trying to win your business.

The annual open enrollment period for Medicare started on October 15 and goes until December 7. It is the one time every year that Medicare beneficiaries have an opportunity to modify their Medicare coverage. During the open enrollment period, you can switch or add a Medicare Advantage plan, switch or add a Part D prescription drug plan and, in some states, like Massachusetts, switch or add a Medigap plan. Any changes that you make take effect on January 1 of next year.

Note: Medicare Advantage users also have an additional Medicare Advantage open enrollment period from January 1 through March 31 each year that allows users to switch Medicare Advantage plans or disenroll from their current plan. It’s sort of like a second look. You can also switch to a five-star-rated Medicare Advantage plan outside of the other open enrollment periods once per year.

This blog post cannot cover everything that you will find in the 128-page Medicare & You 2022 publication, but we’ll try and cover the basics to give you a general understanding of Medicare and your options during the open enrollment period.

Medicare in General

Navigating Medicare and all its parts can be confusing, mainly because of the difficulty of understanding the differences between Medicare Part C, aka Medicare Advantage, and Medigap, aka Medicare supplement insurance. First, though, here is a brief summary of each of the parts of Medicare.

Part A : Covers the cost of inpatient care in hospitals and skilled nursing facilities, as well as hospice and home health care. Part A coverage is free if you (or a current or former spouse) paid Medicare taxes for 40 or more quarters while you were working. If you did not, the premium for Part A ranges from $259 to $471 per month in 2021. The deductible for Part A is $1,484 in 2021, and then you pay coinsurance for additional days spent in the hospital, at a skilled nursing facility, or while in hospice or using home health care.

Part B: Covers the services that are necessary to diagnose and treat medical conditions, including doctors’ visits, outpatient care, emergency department care, preventive care and vaccinations. The standard premium in 2021 is $148.50/month but could be higher if you are subject to an Income Related Monthly Adjustment Amount (IRMAA) surcharge or late enrollment penalty. The deductible for Part B in 2021 is $203. After you meet the deductible, you pay 20% coinsurance of the Medicare-approved amount for the coverage that you receive.

Part C: Part C is also known as Medicare Advantage. Medicare Advantage is Medicare Part A and Part B, and typically Part D, rolled into one plan administered by a private insurance company. The aforementioned deductibles and coinsurance for Part A and Part B are replaced with the insurance companies’ own deductibles, copays, coinsurance and out-of-pocket limits.

Part D: Covers prescription drugs. Premiums vary based on the insurer providing the coverage and the plan selected (covered later), and you could be subject to an IRMAA surcharge . The deductible for Part D varies by plan but will not exceed $445 in 2021. After you’ve paid the deductible, you will start paying copays for your prescriptions until you spend $4,130 combined on drugs in 2021. At that point, you’ll start paying no more than 25% of the cost of your prescription drugs until your out-of-pocket spending is $6,550 in 2021. After you’ve spent this amount, you’ll enter “catastrophic coverage” and pay no more than 5% of the cost of the prescription drugs.

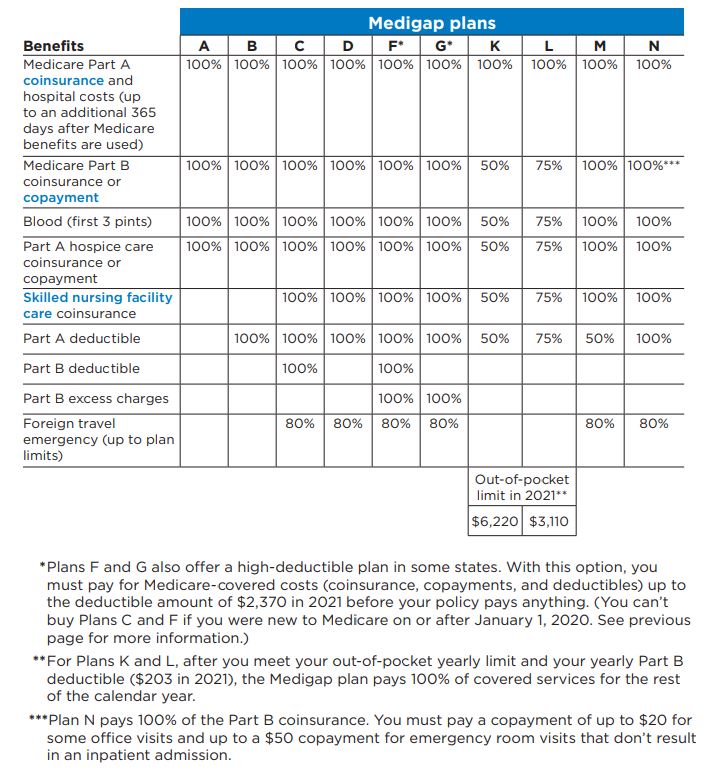

Medigap: Medigap coverage is aptly named, because it fills in the deductible and coinsurance gaps of Medicare Part A and Part B. In most states, there are 10 Medigap plans, while some other states, like Massachusetts, have three different plans.

Medicare Advantage

Medicare Advantage Plans, aka Medicare Part C, Overview

Medicare Advantage is a Medicare-approved plan from a private insurance company that offers an alternative to original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B and usually Part D. Plans may have lower out-of-pocket costs than only using Medicare Part A and Part B, but if you enroll in a Medicare Advantage plan, you will need to use doctors and medical providers that are in the plan’s network and may need a referral to see a specialist. Medicare Advantage plans may also offer some extra benefits that don’t come with Part A and Part B, like vision, hearing and dental services.

Some Medicare Advantage plans are Health Maintenance Organization (HMO) based, while others are HMO Point of Service (HMO-POS) based, Preferred Provider Organization (PPO) based or private fee-for-service (PFFS) based. The differences between these types of plans are beyond the scope of this blog post, but when selecting the type of plan, you’ll want to be sure you’re okay with the network and its coverage area, requirements for preapproval and approvals from a primary care physician, and out-of-network coverage rules.

Medicare Advantage plans can look attractive to people who are new to Medicare and are healthy, and who don’t think they’ll need much medical care. However, as you get older and may require more medical care, the cost of these plans can become high and unpredictable because you’re subject to coinsurance amounts up to the annual out-of-pocket limits, which can go up to $7,550 in 2021 for in-network care and $11,300 in 2021 for out-of-network care.

Zero-Premium Advantage Plans

If you’re searching for Advantage plans, you may find some plans have $0.00 premiums. How is this possible? Medicare pays insurance companies up to $1,000/month for the privilege of managing your health care needs so the insurance company has an incentive to entice you to join its plan with low or no premiums. Even if you choose a zero-premium Medicare Advantage plan, you will likely still have to pay the Part B premium and the Part A premium if you don’t have premium-free Part A.

Medicare Advantage Open Enrollment

If you are covered by a Medicare Advantage plan (or want to be covered by one), during open enrollment you have the opportunity to review all of the Advantage plans that are available to you where you live. You can go to the Medicare Plan Finder to review the Advantage plans that are available in your area.

Medigap

Medigap Overview

A Medigap policy is coverage administered by private insurance companies. It helps cover the gaps in coverage of Medicare Part A (hospital insurance) and Part B (medical insurance). These costs include deductibles, copayments and coinsurances for medical services. There are currently 10 different standardized Medigap plans (see chart below), and each one covers different types of costs. Not all insurance companies offer each type of plan, and the most popular are the F, G and N, which account for 81% of all Medigap plans . Massachusetts has three Medigap plans: Core Plan, Supplement 1 and Supplement 1A. Supplement 1A is very similar to Plan G. Note: If you were new to Medicare on or after January 1, 2020, you can no longer buy the C and F plans or the Supplement 1 plan in Massachusetts.

To purchase a Medigap policy, you must have Medicare Part A and Part B. Different companies charge different premiums for the exact same coverage. As a result, once you determine which Medigap benefits you want, you can determine which policy you buy based on the company and price.

Medigap plans offer cost predictability, because if you choose the Medigap Plan G, all out-of-pocket costs except for the Part B deductible of $203 is covered. So, your total out-of-pocket costs for a given year are limited to the plan premiums plus $203. This also includes any excess charges that private medical providers that do not accept Medicare can charge (limited to 15% above Medicare rates).

With Medigap plans, there is no network and there is no requirement for referrals, so you can get medical care from any public hospital in the country and most private hospitals. This is especially important for patients who travel (think snowbirds) or want to seek medical care in areas that would be out of network with their Medicare Advantage plan. Medigap plans are portable and can be continued if you move to a new state.

Medigap plans do not include prescription drug coverage, so you’ll need to purchase a stand-alone Part D prescription drug plan.

Chart taken from the Medicare & You 2022 guide

Medigap Plan Open Enrollment

Only in specific and limited circumstances do you have a guaranteed issue right to purchase a Medigap policy, which means that you might not be able to change Medigap policies during open enrollment. This means that the policy you purchase during your Medigap open enrollment period when you turn 65 may be the policy you have for the rest of your life.

The best time to buy a Medigap policy is during the Medigap Open Enrollment period, which begins on the first day of the month in which you are 65 or older and enrolled in Part B. If you do try and switch during the annual Medicare Open Enrollment period, you’ll likely be subject to medical underwriting. However, it doesn’t hurt to weigh your options if you want to switch to Medigap from Medicare Advantage or switch Medigap plans.

In Massachusetts, where Medigap plans are called CORE, Supplement 1 and Supplement 1A, residents have an annual opportunity to enroll in Medigap with guaranteed issue. This special rule is only available in Massachusetts, Connecticut and New York, and in Massachusetts, it is available from February 1 to March 31 every year. Premiums for Medigap policies are community rated, which means that all members of each plan pay the same premiums. The premiums aren’t reflective of age.

As mentioned above, in most states, you can’t switch Medigap plans after the Medigap Open Enrollment period without going through medical underwriting, which means that there is no guaranteed issue. Other reasons why you may be eligible for guaranteed issue include if your Medicare Advantage plan discontinues coverage in your area, if you move to an area where your Medicare Advantage plan has no coverage and if your Medigap or Medicare Advantage plan goes bankrupt.

Part D

Prescription Part D Coverage Overview

Medicare Part D is drug coverage provided and administered by private insurance companies. Part D covers brand-name and generic prescription medication and insulin. Each plan determines the medications it will cover and the costs associated with each medication.

Part D Open Enrollment

Your first consideration when selecting a Part D plan is to see whether the plan covers the medications that you need. You want to look at the plan’s coverage rules, specifically the quantity limit and need for prior authorization. Check out the plan’s network of preferred pharmacies, because you’ll likely pay less for medications dispensed at a preferred pharmacy than you will at a standard network pharmacy.

Next, look at all the plan costs, including the monthly premiums, deductibles, copayments and coinsurance. You’ll also want to understand whether the plan will require you to use generics, even if you know the brand name or specialty drug is more effective for you personally. Finally, check to see whether your doctor will need prior authorization from the insurance company before writing the prescription. This administrative requirement may disrupt your regular usage of a particular drug.

It’s also important to note that even if you don’t take medications, you should still consider enrolling in a Part D plan. If you do not, you will be assessed a late-enrollment penalty if/when you next sign up for a Part D plan. The penalty is a surcharge of 1% for every month that you were eligible but not covered.

Comparing Plans

The best resource for comparing Medicare Advantage and Part D prescription drug plans is the Medicare.gov Plan Finder . When using the tool, you’ll want to collect information related to the prescription drugs and the pharmacies that you use because this drives a large portion of your out-of-pocket costs. You also need dosage and frequency of ALL of the prescriptions, because the more accurate you are with this information, the more precise the estimate of your out-of-pocket costs will be.

You don’t want to assume that the Medicare Advantage or Part D prescription drug plan that you had this year is going to be the best plan for next year. Any part of the plan, including the premiums, deductibles, copays, coinsurance, out-of-pocket limits and prescription drug coverages, can change from year to year, so you have to do your homework and review your options each year.

It is important to remember that your health coverage preferences are unique and a plan that works for you may not work for someone else. You need to evaluate plans and coverage based on your own individual health, lifestyle, health care usage, preferences and ability to pay premiums.

You may also want to look at each plan’s star ratings, which indicate the overall satisfaction of current and past plan participants.

The bottom line is that most people should choose a Medigap plan supplemented with a Part D prescription drug plan or a Medicare Advantage plan (which usually includes Part D prescription drugs).

Links to research, not for citation.

A Dozen Facts About Medicare Advantage in 2020 | KFF

medpac_payment_basics_16_ma_final.pdf

Regional Rates Benchmarks 2022 (cms.gov)

pw_g327332.pdf (antheminc.com)

Jonathan Harrington, CFP®, MSFP, MST is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our f ee-only advisors .