Author: Jonathan Harrington

The American Recovery Plan Act (ARPA) has temporarily expanded two key provisions of the tax code that affect families with children 18 or under along with other types of dependents. Not that anything in the tax code is simple, but the new Child Tax Credit and Child & Dependent Care Tax Credit have now become super complicated to understand for 2021. For now, these rules only apply to 2021 and then revert to the old rules in 2022 (pending permanent changes in future tax legislation). In this week’s blog we are going to look at the Child and Dependent Care Tax Credit. We will analyze the Child tax Credit in a future blog.

Child & Dependent Care Tax credit

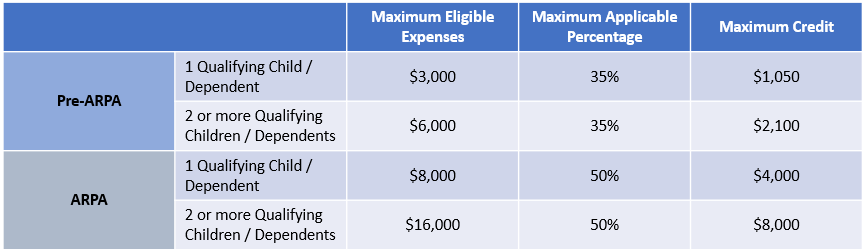

The pre-ARPA child & dependent care tax credit allowed for taxpayers to get a maximum credit of up to 35% on up to $3,000 in dependent care expenses for one qualifying child or $6,000 for two or more qualifying children. A qualifying child is one that is under the age of 13 for the entire calendar year. A qualifying dependent is one who was your dependent and not physically or mentally able to care for himself or herself. Note: For more detailed information on the definitions of qualifying dependent and qualified expenses see IRS Publication 503 .

The ARPA raises the maximum amount of dependent care expenses to $8,000 for one qualifying child/dependent and $16,000 for two or more qualifying children/dependents. This is more than double the pre-ARPA amount!

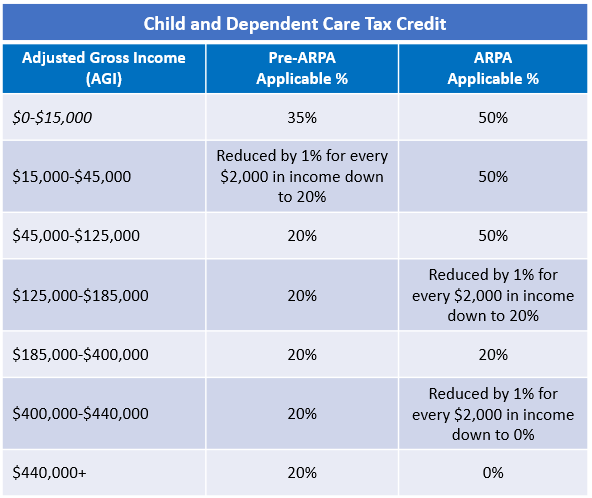

The ARPA also raises the maximum applicable % amount of qualified expenses from 35% to 50%. This applicable % is phased-down to 20% once a taxpayer’s adjusted gross income (AGI) (regardless of filing status) exceeds $125,000. For each $2,000 of income, the applicable % is reduced by 1% down to a floor of 20% once AGI exceeds $185,000.

There is a new complete phaseout for taxpayers (regardless of filing status) whose AGI exceeds $400,000. Once a taxpayer’s AGI exceeds $400,000, the 20% is decreased by 1% for every $2,000 of AGI which means that at $440,000 of AGI, the credit is completely phased out. The pre-ARPA rules for this credit did not have a phaseout and the 20% applied for all levels of income.

Example : Jon and Jane are a married couple with three children under the age of 10. In 2021 they will spend $18,000 on dependent care expenses and their adjusted gross income is $120,000. In this scenario they are eligible to count $16,000 of their dependent care expenses for purposes of the credit, their applicable % is 50% and their credit amount will be $8,000.

Example : Felix and Sarah are a married couple with one child who was born in 2021. During the year they expect to spend $6,000 on dependent care expenses and the expect their adjusted gross income to be $420,000. In this scenario their can count the full $6,000 in dependent care expenses (their maximum amount is $8,000) but their applicable % is only 10% because they are in the final ARPA phase-out range. Their credit amount will be $600.

Get more tax-saving advice for high-earning parents.

Contact us for a free consultation!

Dependent Care Flexible Spending Account (FSA)

New Limit for Contributions to a Dependent Care Flexible Spending Account (FSA)

Note: This is only available if a taxpayer’s employer offers a dependent care flexible spending account benefit for their employees.

Employees can normally contribute up to $5,000 to a dependent care FSA each calendar year if filing married filing jointly, single or head of household or $2,500 if filing married filing separately. In 2021 these limits are more than doubling to $10,500 and $5,250. It is important to note that these limits are not dependent on how many qualifying children (age 13 and under at the end of the calendar year rule still applies) or qualifying dependents that you have and there are no income limitations for being able to contribute. The only restriction is that the total contributions can’t exceed the taxpayer’s earned income for the year which makes sense because the contribution comes from salary deferral.

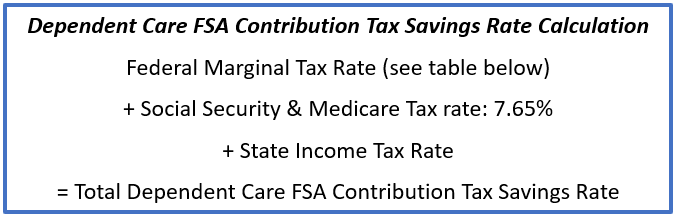

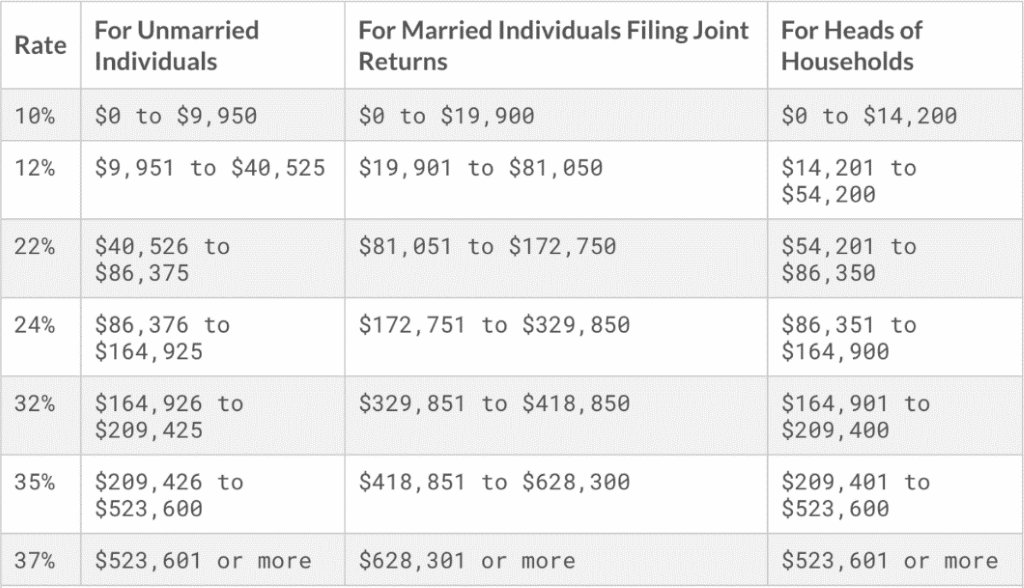

Money that you set aside in a flexible spending account for dependent care expenses is a great tax saver because it not only reduces your taxable income, but also avoids the 7.65% Social Security and Medicare tax. So, if you are in the 22% marginal tax bracket, and you put the 2021 maximum contribution amount of $10,500 into the dependent care FSA, you can save up to $3,113 (29.65% x $10,500) in taxes. If you are in a state with an income tax you can tack on your state’s income tax rate % to your total savings rate.

Child and Dependent Care Tax Credit vs. Dependent Care Flexible Spending Account (FSA)

The question that most parents with qualifying children will have is which option will result in the greatest economic benefit. I.e., Is it better to put money into a dependent care FSA or take the tax credit? The answer to this question largely depends on several things.

1) Are you (or your spouse) able to participate in a dependent care FSA?

2) What is your adjusted gross income.

3) How many qualifying children do you have.

4) What are your expected dependent care expenses in 2021.

If you do not have a dependent care FSA option, then your only option is the child and dependent care tax credit. If you do, then you need to do the math to see how your AGI, # of qualifying children and expected dependent care expenses in 2021 will affect the math in either scenario.

The first step is to calculate the applicable % that you fall into with the child tax credit for 2021 which is dependent on your AGI and # of qualifying children. Then calculate your tax savings rate for dependent care FSA contributions. A dollar-for-dollar credit is generally better than a deduction but depending on your personal factors the credit may not result in the greatest economic benefit for you. If your tax savings rate for dependent care FSA contributions exceeds your applicable % for the child and dependent care tax credit, then use the dependent care FSA contributions first and then use your remaining expenses (if any) for the child and dependent care tax credit.

No Double Dipping

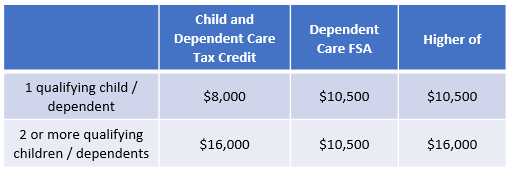

When doing your calculations, it is important to know that you can’t double dip. Any contributions that you make to a dependent care FSA cannot be used for the child and dependent care tax credit and vice versa. But you can take advantage of any combination of the dependent care FSA and the child and dependent care tax credit to maximize your total economic benefit. This is limited to the higher-of-maximum for your # of qualifying children (see chart below).

Integrated Maximums Table

Which is a better example

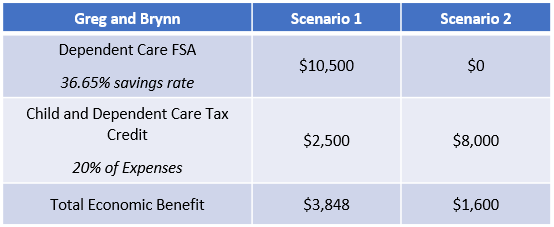

Example : Greg and Brynn have and AGI of $245,000, are in the 24% marginal federal income tax bracket and live in Massachusetts which has a 5% income tax rate. Their total dependent care contribution tax savings rate is 36.65%. They have a 1-year-old daughter who they expect to pay $13,000 in dependent care expenses for in 2021. Their AGI places them in the 20% of dependent care expenses bucket for the child and dependent care credit. In Scenario 1 they max out their dependent care FSA contributions at $10,500 but can’t use the remaining expenses for the child and dependent care tax credit because of the single child limit. In scenario 2 they don’t use a dependent care FSA and instead allocate $8,000 (maximum for one qualifying child) to the child and dependent care tax credit. In this example their total economic benefit is greater when they take advantage of the dependent care FSA first and then use their remaining expenses for the child and dependent care tax credit.

Mid-Year Dependent Care FSA Contribution Election Changes

Dependent care contribution elections are generally required to be decided on before the year starts and then can’t be changed after that unless the employee has a qualifying event (birth of a child, change in employment, change of marital status, change in residence). In 2020, because of Covid-19 and the mayhem it caused in most parent’s lives, the IRS allowed mid-year changes for any reason. This should happen again in 2021.

Summary

The ARPA has greatly increased the opportunity for taxpayers with children and dependents to get tax breaks on the money they are spending on child and dependent care. As we all break out of our Covid-19 cocoons, and send the kids back to daycare, preschool, development centers, etc. make sure that you’re getting as much of tax break as possible on these expenses.

2021 Federal Tax Brackets

Jonathan Harrington, CFP® is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .