Unless you’ve been living under a rock, the fact that there is an election this year is bombarding you . Cable news, radio ads, social media . . . i t’s impossible to escape it. A common question we get as financial advisors is if our clients should do anything different with their investments during an election year, especially in one as tumultuous as this. Here’s a few of our thoughts on what you should (or should not) do with your investments during an election year.

What the past has to say

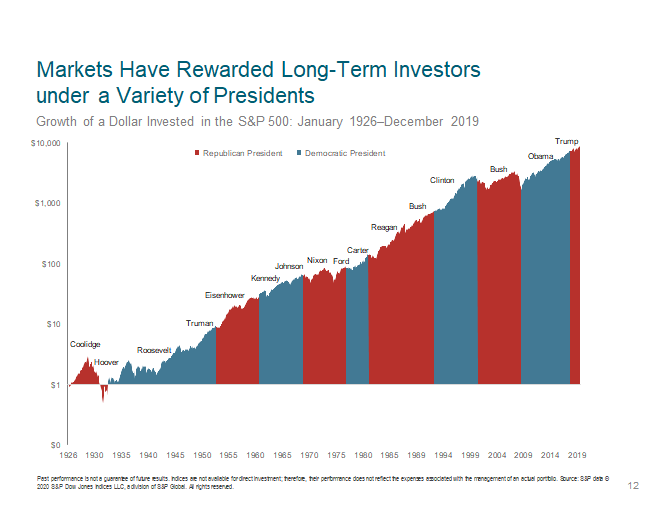

According to research done by Schwab, since 1928, the S&P 500 has ended positive in 17 of the last 23 presidential election years (74% of the time). 1 While past performance does not predict future results, if you sold out of your stock investments because of the increased volatility of an election year, you’d be wrong most of the time. In fact, the stock market on average has increased by 11.3% during all presidential election years. 2

Even when the unexpected happens, the stock market can be even more surprising. In the 2016 election when Trump won, the stock market overnight was down more than 5%. Do you know where it closed that day? The market ended the day up over 1%. 2 We hear countless predictions about what the stock market will or won’t do depending on who wins. When in reality, no one knows for certain what will happen with the stock market . Many experts couldn’t get it right for one day, let alone predicting what it will do a week, a year, or 10 years from n ow . There are too many unknowns to account for, and making any predictions are a guess at best.

Is this time different?

You could argue that 2020 has unique headwinds because of the coronavirus pandemic. But, if you sold out of your investments during the height of the pandemic this year, you would have missed out on the ensuing recovery since the market lows in late March. Although we’re not out of the woods yet, this is just further evidence that it is impossible to time the market. When you attempt to time the market , you need to be right twice . Once when to get out, and a second time for when to get back in.

What the stock market dislikes more than anything is uncertainty. This year has given us plenty of that, with even more possibly to come. We can’t predict what the stock market will do between now and election day. But, because of the uncertainty, we expect it to be quite volatile between now and then swinging up and down as investors attempt to digest all the news and changes between the election, coronavirus, and whatever else 2020 has to offer.

What should you do with your investments?

We’ve said it before, and we’ll say it again, stay the course. When things get bumpy, it’s human nature to want to do something. But that something could be detrimental to your long-term financial goals. We’ve already expressed that it is impossible to predict and time the market. Although past performance does not predict future results, over time, the stock market has always increased in value. We don’t know what will happen in the near-term, but using some history as a guide, we strongly advocate to stay the course and stick to your investment strategy.

This is true regardless of whether you are someone who is optimistic or pessimistic about the near-term direction of the stock market in response to the election. We would neither advocate selling out of your stocks due to the market volatility, nor doubling down and investing your emergency fund because you think your politician will win.

Part of the value we bring as financial advisors is to help our clients stick to their plan regardless of whether they are worried or euphoric about the future. We believe that sticking to your financial plan is the best course of action and making any knee-jerk reactions can be one of the most harmful things you can do for your long-term financial goals.

What if you’re retired?

Even if you are retired, depending on your age and health , retirement can last 30+ years. As we all know, the cost of everything increase s over time due to inf lation. Y our money needs to grow and last to support you through what will hopefully be a long, healthy, happy retirement . Historically , one of the best ways to accomplish this is by investing, and staying invested in, the stock market.

Whether you are retired or not, your investment portfolio should be well diversified to help shelter you from some of the swings in the stock market. A good way to do this is by having some of your investments in high-quality bonds that typically don’t fluctuate nearly as much as stocks do. That way, when you do need money from your portfolio, if stocks have temporarily dropped in value you can sell these investments which haven’t fallen as much until stocks have time to recover.

Since these investments are considered “safer”, they should not be expected to grow over the long-term like stocks do. But they are an important part of a well-diversified investment portfolio . This is why yo u should have investments designated for the long-term (stocks) to provide the necessary growth, but also more stable investments (high-quality bonds/cash) to pull from when there is a drop in the stock market.

Things you can do

Although we certainly do not recommend trying to time the markets, there are always things you can do to improve your financial situation. Focus on the aspects of life that you can control. You can’t control what the stock market will do. You can’t control who will win the election (although you should vote!). What you can control are the decisions that you make day to day that will bring you closer to your goals.

Continue saving and investing

We completely understand that when the market gets rocky it can be tempting to reduce, or even stop, your investment schedule. But as the old adage goes, “buy low, sell high”, many times stock market volatility can work in your favor. No one likes seeing their hard-earned investments decrease in value. But often this can be a great buying opportunity to pick up additional shares at lower prices (on sale , if you will).

Continuing to beat the same drum, it’s impossible to time the market. That’s why we strongly encourage periodic, structured, scheduled investing so you’re not temped to time the market one way or the other. That’s one of the reasons why saving in a 401k is so great. It happens automatically so you’re not thinking about the best time to buy. Sometimes you will purchase shares a little higher, sometimes a little lower, but in the end it all more or less averages out.

Beef up your emergency fund

The common rule of thumb is to have about 3-6 months’ worth of expenses saved in an emergency fund. With so much job and economic uncertainty from the pandemic, we would recommend having more rather than less savings at this time. Having a safe cash cushion is something you should have regardless of whether it’s an election year or not. Making sure you have the reserves necessary to weather a financial storm is something within your circle of influence. If your cash reserves are a little lean, this is something you can work on increasing to put yourself in a better financial position .

Track your spending

Many people are finding that they are spending less money since the pandemic. Not going out to eat, less travel, and entertainment at home have created some extra wiggle room in many budgets. But how much are you really saving (or are you saving at all)?

A little project to take you away from the endless news cycle is to track how much money you a r e spending, on what, and how much you need a month to get by. Going back to the emergency fund, it’s impossible to know how much you should have set aside if you don’t know how much you spend. Working on fine tuning your expenses, and possibly even cutting a little fat from items you may no longer use, can go a long way in having a more solid financial footing.

Summary

Election years are always a little more volatile. But throw in a pandemic, a Supreme Court vacancy, raging wildfires, and so much more, and you have a year for the history books. Regardless of what is happening in the world at this moment it’s important to stick to what you can control.

We don’t know what the future will hold. Trying to predict it is futile. So far, we’ve always made it out the other end, and we don’t anticipate this time to be any different. That’s why we strongly encourage you to not take any drastic actions with your investments because of an election, or anything else , this year throws our way.

If you need assistance with your financial plan or managing your investments, please reach out to our team .