Introduction

Medical expenses can often lead to financial hardship and bankruptcy, so ensuring sufficient health insurance is crucial for any complete financial plan. For many, however, rising premiums make paying for health insurance difficult. Some receive affordable coverage through employers or government programs, but what about the unemployed, the self-employed, and those retiring early? If you're unsure how you might afford the hefty monthly premiums, there is an option: the premium tax credit.

What is the premium tax credit?

The premium tax credit (PTC) was established in 2014 as one of the main components of the Patient Protection and Affordable Care Act (ACA) of 2010. This healthcare overhaul aimed to broaden access to affordable health insurance, reducing the dependence on employment for coverage. The PTC functions as an insurance subsidy for individuals and families with lower incomes who purchase a qualified health plan through their state exchange. It's important to note that the term "lower income" doesn't solely apply to individuals with limited resources; even those with significant financial assets can benefit, though specific rules and restrictions apply.

What is a health insurance marketplace?

For those unfamiliar with health insurance marketplaces/exchanges, here's a brief overview. Introduced as part of the ACA, they enable you to easily shop for and purchase health insurance. Using a website and/or customer service line, you can quickly compare insurers, costs, and coverages. Exchanges are subject to open enrollment periods and to special enrollment periods for those with material changes to their household or health coverage throughout the year. The ACA prohibits exchange insurers from denying coverage based on pre-existing conditions and focuses pricing exclusively on age, household size, tobacco use, and geographical area (for cost-of-living adjustments). Plans are categorized into bronze, silver, gold, and platinum tiers, representing a scale in which platinum plans have the highest premiums and the most coverage. The PTC calculation is partially tied to the cost of a "benchmark plan", equivalent to the second lowest cost silver plan (SLCSP) for your situation. If you purchase marketplace coverage, you will receive an IRS Form 1095-A detailing your enrollment premiums, SLCSP premiums, and the amount of your advance credit (details on this later).

Who can take the PTC?

The PTC has general eligibility rules that include the following:

- Your household income must fall between 100% and 400% of the federal poverty line (FPL) for your family size, as determined by modified adjusted gross income (MAGI).

- You cannot file your tax return as married filing separately.

- You cannot be eligible to be claimed as a dependent on another person's tax return, regardless of whether you are actually claimed.

- You must purchase your insurance through your state health insurance marketplace.

- You must be ineligible for affordable insurance through your employer or other government programs such as Medicare and Medicaid. Purchasing marketplace insurance while eligible for these will not make you eligible for the PTC.

Remember that the IRS often grants exceptions to its own rules, including some mentioned above. To illustrate PTC eligibility, let's consider Jeff, a 60-year-old pre-retiree seeking affordable health insurance when he retires this year. He is a historically diligent saver, has reviewed whether he can afford to retire, and is certain that he will have enough assets to sustain his lifestyle during retirement. His only question is how best to afford health insurance until he turns 65 and becomes eligible for Medicare. Jeff's financial planner reassures him that health insurance expenses may not pose as significant an obstacle to early retirement as he believes. Given that he is otherwise eligible for the PTC, Jeff could qualify to have his premiums greatly reduced if he can keep his income within a certain range early in retirement. So how does it work?

How is the PTC calculated?

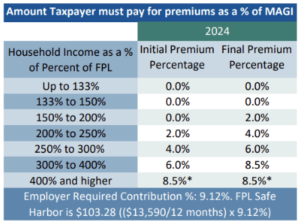

The PTC is among the most unique tax credits available in terms of the way that it's calculated and how it's paid. Let's begin with how it is calculated. Simply put, the PTC formula takes a percentage of your income and subtracts it from the cost of an applicable benchmark plan. The resulting difference determines the amount of credit you are eligible for. If you opt for a plan with a premium higher than the benchmark, your credit remains unchanged, as the extra cost only increases your out-of-pocket expenses. Alternatively, choosing a plan with a lower premium than the benchmark will likely reduce or even eliminate your out-of-pocket payment, but may also reduce your total credit because it's capped at the premium cost of your selected plan. The percentage of your income that the formula uses is based on your household income as a percentage of the FPL for your family size and gets progressively larger as income rises (see below).

Jeff's tax family size is one, which puts his applicable FPL at $14,580 in 2024. Jeff anticipates he'll need $80,000 to achieve his target lifestyle in his first year of retirement, but not all of this will be taxable income to him. Jeff has a portion of his retirement savings in a taxable brokerage account from which withdrawals are included in income only to the extent of the growth in the account. Let's assume that he started investing in this account 10 years ago and that half of the account represents growth, taxed as capital gains. The remainder of the distributions from that account are a non-taxable return of principal (similar to making a withdrawal from your checking account). Let's also say that his investments will generate $5,000 in taxable dividends and interest this year. Jeff has also been diligent about saving in a Roth IRA, so he takes $20,000 from that account to keep his taxable income low and increase his credit. Jeff's total income for the purposes of the PTC will be $35,000 ($30,000 capital gains income + $5,000 interest and dividends) which is 240% of his applicable FPL of $14,580. (His cash flow into his checking account was $30,000 of investment principal + $30,000 capital gains + $20,000 of Roth IRA distributions = $80,000).

If we apply this percentage to the table above, we can establish that Jeff will be expected to pay 3.6%, or $1,260, of his income towards his premiums in 2024. Next, Jeff logs in to his state's health insurance marketplace and inputs his information. The annual premiums for his benchmark plan will be $8,550. If we subtract $1,260 from $8,550, we can determine that Jeff is allowed a maximum PTC benefit of $7,290 this year.

Advance Premium Tax Credit

For many other credits, Jeff would need to wait until filing his taxes in the following year to receive this amount in the form of a reduced tax bill or a greater tax refund. However, the PTC is special in that it can be received far in advance as part of the application process on the health insurance marketplace. If you are likely to qualify, inputting your income information will provide you with an estimated credit amount to be paid directly to the marketplace on your behalf each month, effectively reducing your out-of-pocket premiums. This is known as the advance premium tax credit (APTC). When Jeff applied, his estimated monthly APTC amount was $607.50 per month, or $7,290 per year, assuming his income will indeed be exactly $35,000 this year. In reality, annual income is not that easy to predict for a multitude of reasons. If Jeff's income ends up being higher or lower than expected, his tax preparer will need to reconcile the amount received in advance with the true amount available to him.

It stands to reason that if Jeff's income is significantly different from his estimate, he will be eligible for a different amount of credit than he received in advance. If income is higher, then Jeff may need to pay back some of his advanced credit with his tax filing as he was not actually entitled to it. If that's the case and his income is less than 400% of his applicable FPL, then he will have the potential benefit of a repayment limitation. No such benefit exists when income is more than four times the FPL and people in this category may have to repay their full advanced credit amount. If income is far lower than expected, there is no payment limitation, and the reconciliation will generate a refundable credit for the full amount allowed.

Additional notes

- The PTC was bolstered by the Inflation Reduction Act of 2022 making a greater amount of credit available to more taxpayers. It also removed the "cliff" effect when MAGI rises over 400% of the FPL, meaning people at this level of income aren't automatically precluded from receiving subsidies as they were before. These changes are effective through 2025.

- Those familiar with the incredible tax benefits of Health Savings Accounts (HSAs) should know that marketplace high-deductible health plans qualify for HSA contributions. Also, because the PTC is based on a specific version of MAGI that allows HSA deductions, contributions will reduce your income and potentially generate a higher subsidy amount.

- Current tax law permits health insurance expenses in excess of 7.5% of AGI to be included on Schedule A of the Form 1040 as an itemized deduction. If you receive PTC subsidies, only the amount paid greater than what you receive can be applied toward the deduction.

- If you're interested in diving even deeper into this credit, see this additional IRS Resource covering common questions.

Conclusion

The premium tax credit is a powerful planning tool for individuals and families across many levels of wealth, but it's not the only one. Everybody's financial situation is unique, and the expertise of an experienced financial planner is invaluable when determining which strategies are best for you. If you feel you could use assistance with your retirement, tax, or insurance planning, please reach out to our team.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.