A common question we get as financial advisors is whether our clients should do anything different with their investments during an election year, especially in one as tumultuous as this. Here are some of our thoughts on what you should (or should not) do with your investments during an election year.

What the past has to say

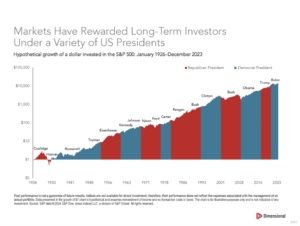

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In USD. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 index. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

Is this time different?

You could argue that 2024 has unique headwinds (insert unique economic factors here depending on your point of view). It doesn’t matter what year we are writing this or what the economic factors are; when you attempt to time the market, you need to be right twice: once as to when to get out and a second time for when to get back in.

What the stock market dislikes more than anything is uncertainty, which is why the most volatile days tend to be those of crisis, like 9/11/2001 and the March 2020 coronavirus pandemic, to name two. We can’t predict what the stock market will do between now and election day. However, because of uncertainty, we expect it to be volatile between now and then, swinging up and down as investors attempt to digest all the news and changes between the election and whatever else 2024 has to offer.

What should you do with your investments?

We have said it before, and we will say it again: stay the course. When things get bumpy, it’s human nature to want to do something. But that could be detrimental to your long-term financial goals. We have already said that it is impossible to predict and time the market. Although past performance does not predict future results, over time, the stock market has always increased in value. We do not know what will happen in the near term, but using some history as a guide, we strongly advocate staying the course and sticking to your investment strategy.

This is true regardless of whether you are optimistic or pessimistic about the near-term direction of the stock market in response to the election. We would neither advocate selling out of your stocks due to market volatility nor doubling down and investing your emergency fund because you think your politician will win.

Part of the value we bring as financial advisors is to help our clients stick to their plans, regardless of whether they are worried or euphoric about the future. We believe that sticking to your financial plan is the best course of action and making any knee-jerk reactions can be one of the most harmful things you can do for your long-term financial goals.

What if you are retired?

Even if you are retired, depending on your age and health, retirement can last 30+ years. As we all know, the cost of everything increases over time due to inflation. Your money needs to grow and last to support you through what will hopefully be a long, healthy, and happy retirement. Historically, one of the best ways to accomplish this is by investing and staying invested in a diversified portfolio of stocks.

Whether you are retired or not, your investment portfolio should be well diversified to help shelter you from some of the swings in the stock market. A good way to do this is by having some of your investments in high-quality bonds that typically don’t fluctuate nearly as much as stocks do. That way, when you do need money from your portfolio if stocks have temporarily dropped in value, you can sell these investments, which have not fallen as much, until stocks have time to recover.

Since these investments are considered “safer,” they should not be expected to grow over the long term like stocks do. But they are an important part of a well-diversified investment portfolio. This is why you should have investments designated for the long term (stocks) to provide the necessary growth, but you also need more stable investments (high-quality bonds/cash) to pull from when there is a drop in the stock market.

Things you can do

Although we certainly do not recommend trying to time the markets, there are always things you can do to improve your financial situation. Focus on the aspects of life that you can control. You cannot control what the stock market will do. You cannot control who will win the election (although you should vote!). However, you can control the decisions you make daily that will bring you closer to your goals.

Continue saving and investing

We completely understand that when the market gets rocky, it can be tempting to reduce or even stop your investment schedule. But as the old saying goes, “buy low, sell high,” stock market volatility can work in your favor. No one likes seeing their hard-earned investments decrease in value. But often, this can be a great buying opportunity to pick up additional shares at lower prices (on sale, if you will).

Continuing to beat the same drum, we remind you that timing the market is impossible. That is why we strongly encourage periodic, structured, and scheduled investing so you’re not tempted to time the market one way or the other. That is one of the reasons why saving in a 401(k) is so great. It happens automatically, so you are not thinking about the best time to buy. Sometimes you will purchase shares a little higher, sometimes a little lower, but it all averages out in the end.

Many people do not realize that their rate of savings is more important than their rate of return. The volatility swings of the stock market will even out over time, but if you are not saving aggressively, you may not accumulate what you need to live on later in life.

Beef up your emergency fund

The common rule of thumb is to have about three-to-six months’ worth of expenses saved in an emergency fund. Having a safe cash cushion is something you should have regardless of whether it is an election year or not. Making sure you have the reserves necessary to weather a financial storm is something within your circle of influence. If your cash reserves are a little lean, this is something you can work on increasing to put yourself in a better financial situation.

Evaluate your estate planning

At any point in your life, it is important you have planned for risks to your financial life, such as making sure:

- You have estate planning documents in place that support your wishes and protect those close to you from your incapacity or premature death.

- Your beneficiary designations are up-to-date and match your estate planning.

- If you live in Massachusetts, your estate planning has been updated for the new rules regarding the estate exemption amount.

- If you are remarried, you have protected your new spouse without disinheriting your kids.

Summary

Election years are always a little more volatile. Regardless of what is happening in the world at this moment, it is important to stick to what you can control.

We do not know what the future will hold. Trying to predict it is futile. So far, we have always made it out to the other end, and we do not anticipate this time to be any different. That is why we strongly encourage you not to take any drastic action with your investments because of an election or anything else this year throws our way.

If you need assistance with your financial plan or managing your investments, please reach out to our team.

Additional resources:

Secure Your Retirement: Investing for Your Future | Milestone Financial Planning

Mastering Diversification: Your Guide to Smart Investing (milestonefinancialplanning.com)

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.