The Tax Cuts and Jobs Act of 2017 (TCJA)

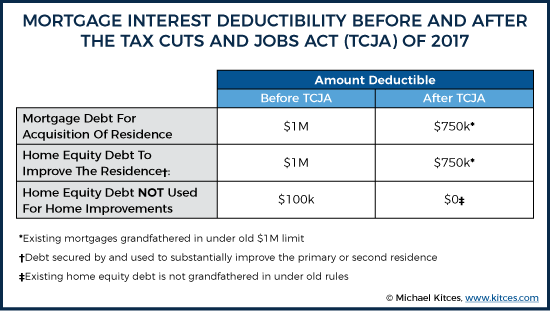

The “Tax Cuts and Jobs Act of 2017” (TCJA) eliminated the itemized tax deduction for “home equity indebtedness” starting in 2018 . Does that mean that anyone with a “home equity loan” can no longer deduct the interest? No, it does not. It depends on what you used the home equity loan for. Homeowners can still deduct the interest on up to $750,000 or $1,000,000 of “acquisition indebtedness” (depending on when they obtained the debt) as an itemized deduction.

Note: The lower limitation of $750,000 applies to new mortgages taken out after December 15th, 2017. Existing mortgages retain their deductibility of interest up to $1,000,000 of indebtedness.

Note: There is no grandfathering of the ability to deduct up to $100,000 in home equity debt not used for “acquisition indebtedness” (see below). In other words, if you used your home equity loan to pay off a car loan, credit cards, for a vacation or for ANY other reason besides “acquisition indebtedness” then it isn’t deductible in 2018 and beyond.

What is Acquisition Indebtedness?

The IRS defines “acquisition indebtedness” as “debt used to acquire, build, or substantially improve the primary residence.” The debt must also be secured by the residence (e.g. it can’t be on your credit card). So if you have both a traditional mortgage and a home-equity loan or line-of-credit that you used to acquire, build or substantially improve your primary residence, then you can deduct the interest on that debt up to the aforementioned limits.

How Much Interest Should I Deduct?

If you have a situation where you have both a mortgage and a home equity loan that exceeds the deductibility limits then you should work with your tax preparer to determine how to calculate the correct amount of interest to deduct.

An example would be if you had a $1.2 million traditional mortgage and a $150,000 home equity loan used to add an addition to your house. Your total acquisition indebtedness is $1.35 million. Unfortunately, the 1098 that you will get from the bank won’t tell you how much of the interest associated with the $1.35 million in loans is deductible.

What is the Standard Deduction?

Something else to keep in mind is that the standard deduction has been increased for 2018 to $12,000 for single taxpayers and $24,000 for married taxpayers. So, if your itemized deductions don’t exceed these thresholds, then it doesn’t really matter if you can or cannot deduct home equity loan interest.