Author: Jonathan Harrington

Do you work for a public school, college or university run by a state or local government that offers a 457(b) plan in addition to a 403(b) plan? If so, you may be able to double your retirement plan contributions and start socking away some serious cash for retirement.

403(b) Plan Basics

A 403(b) plan is a form of retirement plan with preferential tax treatment that can be set up by public schools, colleges and universities and certain 501(c)(3) organizations like churches, hospitals and charitable organizations. It is very similar to the 401(k) plan that private employers offer. Contributions to the plan reduce your income taxes, and distributions from the plan are taxable.

457(b) Plan Basics

A 457(b) plan is a form of retirement plan with preferential tax treatment that can be set up by a state or local government (governmental plan) or a tax-exempt organization under IRC 501(c) such as a charitable organization (nongovernmental plan).

Note: In this blog article, we are going to discuss governmental 457(b) plans that apply to public schools, colleges and universities and have more favorable rules than a nongovernmental 457(b) plan.

Can an Employer Have Both 403(b) and 457(b) Retirement Plans?

Yes! If you happen to work for a public school, college or university (which have both 457(b) and 403(b) plan eligibility), you may have the option of contributing to both a 403(b) and a 457(b) plan. For example, here in New Hampshire, the University System of New Hampshire has both 403(b) and governmental 457(b) plans . If you work for UNH, Plymouth State University, Keene State College, Granite State College, or a Massachusetts state college such as the University of Massachusetts system, you likely have access to these plans.

Contribution Limits

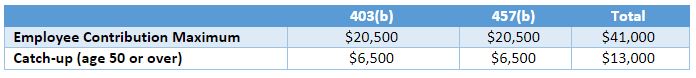

403(b) and governmental 457(b) participants are subject to the same contribution limits. In 2022 the elective deferral limit for employees is $20,500 with a $6,500 catch-up available for employees aged 50 years or over. The bonus for employees who have both 403(b) and 457(b) plans is that they can make contributions to both plans up to the annual limits.

Example: Stacy works for the University of New Hampshire, which has both a 403(b) and a 457(b) plan. She is 30 years old, so she is not eligible for the age 50 or over catch-up. In 2022, she can contribute up to $20,500 to her 403(b) plan and an additional $20,500 to her 457(b) plan.

2 022 Employee Contribution Limits for the University System of New Hampshire Retirement Plan

Note: In both 403(b) and 457(b) plans, contributions are limited to 100% of the employee’s compensation. If an employee’s gross wages are under the maximum contribution limits, then that employee’s contribution is limited to the amount of their wages for the year.

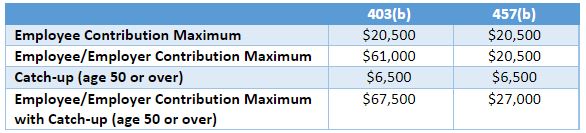

Employer Contributions

Employers can, but are not required to, make contributions to a governmental 457(b) or 403(b) plan. Employer contributions to a 403(b) plan allow for total employee/employer contributions to exceed the employee maximum of $20,500 in 2022, up to a limit of $61,000. Employer contributions to a 457(b) plan count toward the employee’s maximum contribution limit, and the total of employee/employer contributions cannot exceed $20,500.

2022 Employee/Employer Contribution Limits for 403(b) and 457(b) Plans

Note: 403(b) plan contributions are subject to the contribution limits from all defined contribution plan sources including 401(k)s, SIMPLE IRAs and the Thrift Savings Plan. If an employee is contributing to another 403(b), a 401(k), a SIMPLE IRA or the Thrift Savings Plan during the year, the total that the employee can contribute to all of these plans is $20,500 in 2022. The $6,500 age 50 or older catch-up extends this limit for the employee.

Roth Contributions to 403(b) & 457(b) Plans

We often talk about how great Roth contributions to retirement plans can be. Even though you don’t get a tax deduction for making Roth contributions, your investments within the Roth account grow tax free and are not subject to tax when distributions are taken. 403(b) and 457(b) plans can both allow for Roth accounts, giving people in different tax situations the flexibility to make the type of contribution (traditional or Roth) that makes the most financial sense for their individual circumstances. Not all plans will allow for Roth contributions, however – so check with your employer.

Example: Stacy (mentioned above) wants to contribute equally to both tax-deferred and Roth accounts in her retirement plans at UNH. She decides to make a $20,500 tax-deferred contribution to her 403(b) plan and a $20,500 Roth contribution to her 457(b) plan.

403(b) Special Catch-up

403(b) plans also have a special catch-up for employees with more than 15 years of service at the plan sponsor. These employees can make an additional contribution of up to $3,000 per year (on top of the age 50 or over catch-up) up to a lifetime cap of $15,000.

Example : Ron has worked for UNH for 15 years as of 2021. He is 55 years old and participates in the UNH 403(b) plan. For years 2022-2026, Ron can make the normal employee contribution of $20,500 (2022), the age 50 or over catch-up of $6,500 (2022), and a special catch-up of $3,000 for a total of $30,000.

457(b) Special Catch-up

Governmental 457(b) plans have a special catch-up that is allowed for the three years prior to the year of the employee’s normal retirement age. In these three years, the employee can contribute up to the lesser of 1) $41,000 (two times $20,500 – the 2022 elective deferral limit) or 2) the current-year elective deferral limit ($20,500 in 2022) plus unused elective deferral limits in prior years.

In other words, if an employee has contributed the maximum elective deferral limit in all of the years they were eligible for the plan, then the employee can’t take advantage of the special catch-up. But if there were years that they did not make contributions to the 457(b) plan, these past missed contributions can be made up in the final three years approaching the normal retirement age (as defined by the plan), up to $41,000 per year (in 2022).

Note: This special catch-up cannot be made in addition to the age 50 or over catch-up of $6,500. The participant must choose one or the other.

Example: Bobby has been working for the University of New Hampshire for 11 years. He will turn 62 in 2022 and will be in the special catch-up window from 2022 to 2024. He only started making contributions to the 457(b) plan starting in 2017, and he missed six years of contributions because he didn’t know about the 457(b) plan.

Over those six years, he missed a total of $104,850 of possible contributions. However, he can use those missed contributions during his three-year special catch-up window. In 2022, the normal contribution limit is $20,500, and under the special catch-up rules he would be able to contribute up to the lesser of 1) two times $20,500 ($41,000) or 2) the total of his past missed contributions ($104,850).

In 2022, his missed contribution balance would be reduced by $41,000, leaving him with a balance of $63,850 for 2023. In 2023 he would again be able to contribute two times $21,000 (projected 2023 contribution limit) or $42,000. In 2024 he would only have $21,850 left of past missed contributions and so would not be able to contribute the $42,000 as a special catch-up in his final year, but would be limited to the $21,850.

403(b) Withdrawals

A 403(b) plan may, but is not required to, allow for hardship distributions. If permitted by the plan, participants may obtain a hardship distribution to the extent and in the manner allowed by the plan.

In addition to hardship distributions, a 403(b) plan may allow employees to take money out of the plan when they 1) reach age 59½, 2) have a severance from employment, 3) become disabled, 4) die or 5) encounter a financial hardship. Employees may also receive a qualified reservist distribution.

Distributions taken prior to age 59½ are subject to a 10% penalty.

457(b) Post-Service Withdrawals (a.k.a. Penalty Fee Distributions)

Post-service withdrawals (after severance from employment with the employer sponsoring the plan) from 457(b) plans are allowed at any time and do not have a 10% early withdrawal penalty, even if you take a distribution when you are under 59½. This is a HUGE advantage over 403(b) and 401(k) plans.

457(b) In-Service Withdrawals

The rules for withdrawals from 457(b) plans while the employee is still working for the plan sponsor are quite restrictive; withdrawals are not allowed, with two exceptions.

Exception 1: Voluntary withdrawal: Employees can request a one-time withdrawal of $5,000 or less, but only if they have not previously made a withdrawal in the plan and have not made any tax-deferred contributions in the past two years.

Exception 2: Hardship withdrawal: Employees experiencing an “unforeseeable emergency” can request a withdrawal from their accounts. The guidelines for these types of withdrawals are set by the IRS, are very restrictive and must meet one of the following four criteria:

- An illness or accident of the participant, the participant’s beneficiary, or the participant’s or beneficiary’s spouse or dependent.

- Property loss caused by casualty (for example, damage from a natural disaster not covered by homeowner’s insurance) of the participant or beneficiary.

- Funeral expenses of the participant’s spouse or dependent.

- Other similar extraordinary and unforeseeable circumstances resulting from events beyond the control of the participant or his or her beneficiary (for example, imminent foreclosure or eviction from a primary residence, or to pay for medical expenses or prescription drug medication).

The participant seeking the distribution must show that the emergency expenses could not otherwise be covered by insurance, liquidation of the participant’s assets or cessation of deferrals under the plan.

Distributions because of the unforeseeable emergency must be limited to the amount reasonably necessary to satisfy the emergency need (which may include any amounts necessary to pay any federal, state or local income taxes or penalties reasonably anticipated to result from the distribution).

New home purchases, credit card debt and college tuition have been noted by the IRS as not unforeseeable emergencies and thus not eligible for hardship withdrawals.

403(b) and 457(b) Rollovers

Rollovers from governmental 457(b) and 403(b) plans to a 401(k), 403(b), 457(b) or IRA are allowed subject to individual plan rules. If you stop working for the 403(b) or governmental 457(b) plan sponsor, you can either leave your funds with your previous employer, roll them into a retirement plan offered by your new employer or roll them into an IRA. The key is that you have flexibility to make the decision that makes sense for you. This is a critical difference from a 457 plan offered by a nonprofit – rollovers of those plans are not allowed.

Note: 403(b) plans can allow in-service rollovers, but 457(b) plans cannot.

457(b) and 403(b) Plan Investments

Investment options for participants in 403(b) and 457(b) plans will vary by plan. The University System of New Hampshire allows its employees to set up accounts at TIAA and Fidelity , giving employees a great deal of flexibility in choosing investments within their plans. The best way to ensure you make the best investment decision is to inform yourself, do your research and reach out to a qualified financial advisor for guidance.

Summary

Tax-preferential retirement accounts like 403(b) and 457(b) plans are the best way to save for retirement. Most workers only have the ability to contribute to one type of retirement plan. But if you work for a public school, college or university, you may have the ability to contribute to both a 403(b) and a 457(b) plan, effectively doubling your capacity for tax-free savings. If you are one of the lucky few who fall into this group, do your best to take advantage of the potential of these plans. As always, we are here to help, so feel free to reach out to us with any questions.

Jonathan Harrington, CFP®, MSFP, MST is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .