It seems like yesterday, but in the pre-COVID-19 calm before the storm of December 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act. The Act had many provisions, but the most important were increasing the beginning age for taking RMDs from age 70.5 to 72 and a new set of guidelines that effectively ended the Stretch IRA for most non-spouse beneficiaries of IRAs.

Well, three years later, on December 23, 2022, Congress tucked SECURE 2.0 into the Consolidated Appropriations Act of 2023, and here we go again. SECURE 2.0 has a bonanza of changes related to retirement plans. Some have broad effects and others apply to small groups of people. Implementation of the new rules is spread out over the next 10 years, but most are effective in 2023, 2024 and 2025.

Over the next few months (and maybe years), we’ll cover different parts of SECURE 2.0 in our blog posts, but we’re starting with one of the most significant pieces of the act and one that is extremely timely: required minimum distributions (RMDs).

RMD Beginning Age Extended to 73

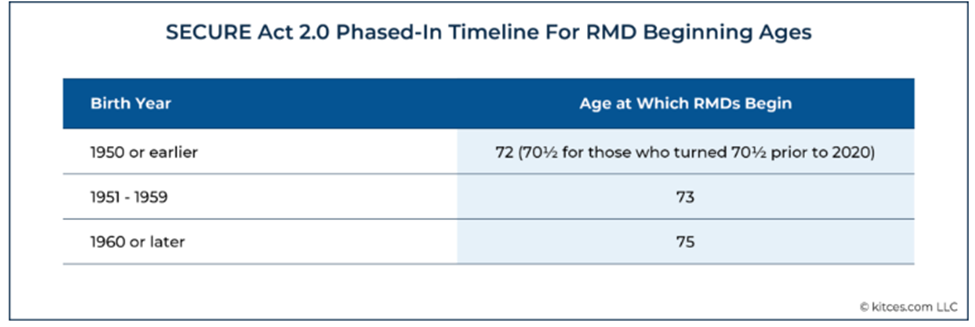

The original SECURE Act of 2019 raised the beginning age for RMDs from age 70.5 to 72, and 72 remained the age for 2020, 2021 and 2022. SECURE 2.0 pushes the required beginning age out further—to age 73 starting in 2023, which means that anyone turning 72 in 2023 (born in 1951) will be exempt from taking RMDs in 2023 and will start taking their RMDs when they turn 73 in 2024. Anyone born in 1960 or later will have their beginning date pushed to age 75, starting in 2033; however, that might change again between now and then.

If you turned age 72 in 2022 , then you will still need to take an RMD for 2022 by April 1, 2023, even if you waited until 2023 to take it.

In addition, the bill decreases the penalty for late or insufficient RMDs from 50% to 25% of the undistributed RMD amount and further to only a 10% penalty if a full correction is made within a timely manner.

We’ll talk about changes related to qualified charitable distributions (QCDs) in more detail in another post, but SECURE 2.0 did not change the date when QCDs can start to be made. This age remains the year the IRA owner turns 70.5.

Not having to take RMDs and realize taxable income allows taxpayers to put off recognizing income from mandatory distributions from IRAs, 401(k)s and 403(b)s. This could, in turn, help you prevent being subject to Income-Related Monthly Adjustment Amounts (IRMAA) for Medicare Part B and Part D and/or give you more time to make Roth conversions.

Roth Accounts in 401(k), 403(b) and 457(b)—No More RMDs

Starting in 2024, RMDs will no longer need to be made from Roth accounts in 401(k)s, 403(b)s, 457(b)s and the Thrift Savings Plan (TSP). This change in SECURE 2.0 makes the treatment of these types of accounts the same as that applied to Roth IRAs. It is also a whole lot better for these account holders who now have the option of keeping the money in the Roth account for longer tax-deferred treatment. This new rule applies even for account owners who may have already started taking RMDs from Roth 401(k)s, 403(b)s, 457(b)s or the TSP. For those account owners, 2023 will be the last year that they need to take a distribution from their Roth account portion of these employer-sponsored retirement plans.

This is not to be considered tax advice. Please review your personal situation with your tax and/or financial advisor. Jonathan Harrington, CFP®, MSFP, MST is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .