BREAKING NEWS – On December 3, 2024, the US District Court for the Eastern District of Texas issued a nationwide preliminary injunction against the CTA and BOI reporting rule, declaring it unconstitutional. According to the ruling, "Reporting companies need not comply with the CTA's January 1, 2025, BOI reporting deadline pending further order of the Court." This may not be the final word on the subject, so you may still want to file as a precaution.

Many people have heard about a new law that requires many small businesses to report certain information to the US government to prove the identity of their "beneficial owners." The Corporate Transparency Act (CTA) established uniform beneficial ownership information (BOI) reporting requirements for certain corporations, limited liability companies, partnerships, and other entities created in or registered to do business in the United States. This rule is intended to help prevent and combat money laundering, terrorist financing, corruption, tax fraud and other illicit activity.

These individuals and entities must all obtain Financial Crimes Enforcement Network (FinCEN) identifiers. If you don't already have this ID, one will be assigned to you during the filing process.

There are steep penalties for not filing – fines up to $5,000 per day! Luckily, filing the form is relatively easy using the FinCEN website.

Below are some questions and answers regarding the new law.

When was the law effective?

January 1, 2024

When are the Beneficial Ownership Information reports due?

A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial BOI report.

New companies created between January 1, 2024, and December 31, 2024, will have 90 calendar days from actual or public notice that the company's creation or registration is effective to file their initial BOI reports with FinCEN.1

New companies created on or after January 1, 2025, will have 30 calendar days to report.

What businesses have to file?

Certain businesses must file reports with FinCEN annually about every individual who is a "beneficial owner." Companies created on or after January 1, 2024, must also report this information for any "company applicants."

Who meets the definition of a "beneficial owner"?

A beneficial owner is any individual who exercises "substantial control" over the entity or who controls at least 25% of the company's ownership, including profits-only interests.

Who meets the definition of a "company applicant"?

A company applicant is an individual who files a document that creates or registers the reporting company or who was primarily responsible for directing or controlling the filing. Attorneys and paralegals may fall under this definition.

Who meets the definition of an individual who exercises "substantial control"?

An individual who exercises substantial control is:

- A senior officer, including general counsel, the chief executive officer, the chief financial officer, the chief operating officer or any other officer who performs a similar function

- Someone who has authority to appoint or remove certain officers or a majority of directors of the reporting company

- An important decision-maker for the reporting company

- Someone with any other form of substantial control over the reporting company

Is there a tax or fee associated with filing the report?

No.

How does a business file its BOI report?

FinCEN is responsible for collecting these reports, which are to be filed electronically through FinCEN. Note that if you don't already have a FinCEN ID, one will be assigned to you during the filing process.

What companies are required to report?

Any nonexempt company created by the filing of a document with a secretary of state or similar office under state law or Indian tribe, including foreign companies, must report.

What entities are exempt from filing?

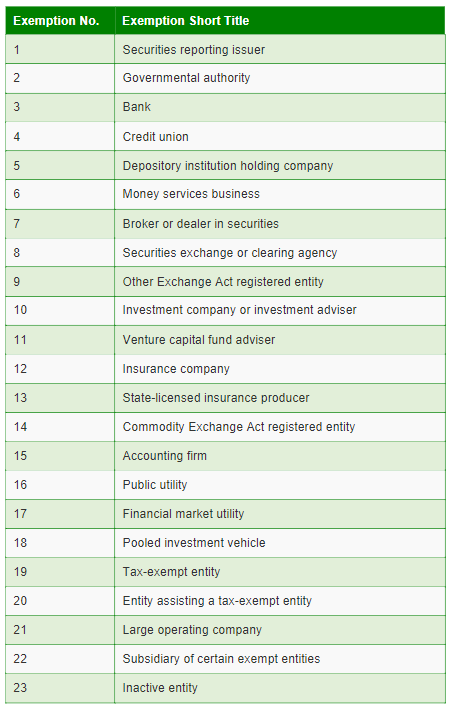

Under the Corporate Transparency Act, there are 23 types of entities that are exempt from filing these reports, including accounting firms, investment advisers, banks and credit unions, security brokers, insurance companies, nonprofits, and inactive entities:2

What information must be disclosed about beneficial owners and/or company applicants?

- Legal name

- Date of birth

- Residential address

- Unexpired copy of an identifying document, which can only be a passport, driver's license or other form of US government identification

This is not a comprehensive list of all aspects of the new rule. Please review this information with your accountant and attorney to see whether your company must file.

If you have any questions regarding your personal financial planning or tax planning, please reach out to our team.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.