Series I bonds (the I stands for inflation) are all the rage right now because of their currently high yields in an otherwise low-yielding savings environment. But before you tap into your home equity line of credit to max out your I bond purchases, you need to understand the mechanics of how I bonds work.

What is an I bond?

An I bond is a bond issued by the US government on which you earn interest at a rate tied to inflation and guaranteed by the federal government. If you buy an I bond today (June 2022), you will earn 9.62% interest, which is tied to the Consumer Price Index (CPI-U). The bond earns interest for up to 30 years. You can also defer paying federal tax on the interest until you redeem (cash in) the bond, and there is no state or local tax on the interest.

There are two components to the interest rate you receive on an I-bond. There is a “fixed rate” that is set when you buy the bond and does not change. The fixed rate is often (and currently) 0% and has never been more than 0.5% since 2008. In addition, there is a variable interest rate on the I bond changes every six months (in May and November) to match the current inflation rate. The combined inflation and fixed rate will never be less than 0%, even if the United States experiences deflation (negative CPI-U).

The fixed interest rate is set for your bond when you buy it. The variable (inflation) rate changes every six months. After six months at the initial rate, the interest changes to whatever the current rate is for another six months. Each month, your bond earns the combined rate of the fixed and variable rates.

For example, you can purchase I bonds at the 9.62% rate up until October 31, 2022, and even if you buy them on that last day before the rate resets on November 1, 2022, you will still receive the 9.62% rate for six months.

Interest is compounded semiannually. If you buy an I bond on (say) June 30 rather than July 1, you will get an extra month’s interest (for the entire month of June).

Getting I bonds

There are two ways that you can get I bonds. The most common method is through the Treasury Direct website . The other is on your tax return.

You have to buy I bonds from a special government website at https://www.treasurydirect.gov/ . You can’t buy them from a bank or in an investment account. The Treasury Direct website requires two-factor authentication, and you can also buy other types of savings bonds and Treasury bills, notes, and bonds on this website.

I bonds are currently limited to $10,000 / year in purchases per Social Security number or tax identification number. For example, if you are married with two children, you could purchase up to $40,000 ($10,000 for each person) in I bonds.

If you have a federal tax refund, you can use IRS Form 8888 to allocate up to another $5,000 of your federal refund to purchase paper I bonds, which can be converted to electronic bonds after you receive them. Note: This $5,000 limit applies to both you and your spouse if you are filing jointly. There is also a risk that the I bonds will not be issued if the tax refund is decreased because of a math error or the refund is offset for any reason, in which case the refund will be turned into a check instead of a bond purchase.

Gifting I bonds

You can buy I bonds for others, such as children or grandchildren , either electronically or in paper form. If you want to do it electronically, you must have a Treasury Direct account and the recipient’s full name and Social Security number. Electronic purchases of I bonds are subject to the $10,000 / year individual limit. Getting paper I bonds as gifts must be done through the federal tax refund process mentioned earlier and is limited to giving bonds to two people per year.

Comparing returns

The I bond rate was well under 3% for the 10 years before the end of last year. The typical rate for regular bonds (commercial, mortgage, municipal bonds) has historically slightly outperformed the inflation rate. And although stocks are much more volatile, they have historically produced a much higher return over the long term.

Holding periods

If you need the cash you intend to use to buy I bonds within the next year, do not buy them, because the minimum ownership period is one year. It is impossible to redeem an I bond before the one-year holding period has been completed. If you redeem an I bond after the minimum one-year holding period but before holding it for five years, you forfeit the last three months’ interest. After holding it for five years, you can redeem the I bond with no penalty.

What about taxes?

Interest earned on I bonds is subject to federal income tax but not state or local income tax. The interest earnings can be reported annually or deferred until you redeem the bond or it reaches its full maturity after 30 years.

Once you start to report the interest every year, you must continue to do it every year for ALL of the I bonds that you currently own or acquire after that date. You will not receive a 1099-INT from the Treasury until you redeem the I bond or it matures, so you must calculate the annual interest yourself. This is a record-keeping nightmare, so most I bond owners will wait until they receive a 1099-INT to report the interest.

If your I bond is inherited, the beneficiary will owe tax on the accumulated interest. This is different from an heir inheriting a stock or mutual fund where (currently) the gains are tax-free after getting a step-up in basis.

Use cases for I bonds

- Short-term (beyond one-year) savings: If you are saving up for a short-term goal, say three to six years, I bonds may be a good conservative choice, maybe for a house down payment, kids going to college soon, or the trip of a lifetime. Since you can’t access I bonds until one year after purchase, I bonds should not be used for an emergency fund. If you have current savings that are in a CD, money market, or savings account, you could allocate a portion of this to I bonds to get the higher rate (purchase limitations apply).

- Educational expenses: The education tax exclusion permits qualified taxpayers to exclude from their gross income all or part of the interest paid upon the redemption of eligible savings bonds when the bond owner pays qualified education expenses at an eligible institution . If your income is below the threshold ($98,200 single, $154,800 joint, as of 2021), and you bought the I bond when the owner was an adult (over age 23), you qualify for this exemption.

- Interest rate arbitrage: If you have a mortgage or other low-interest debt with an interest rate lower than the current I bond rate, you can buy I bonds instead of making extra payments on the mortgage or other low-interest debt. Of course, the viability of this strategy will fluctuate over time along with the I bond rate.

- I bond portfolio: You have the potential to accumulate a significant number of I bonds over the course of time and make them part of the fixed income portion of your investment portfolio. Since the rate of return will always be equal to inflation (plus a possible fixed component), you can use I bonds as the hedge against the inflation portion of your retirement savings.

Beneficiaries

Beneficiaries for I bonds are done for each registration that you have purchased. If you have bought all of your I bonds in one transaction, you only have one registration. If you have set up a periodic purchase plan for buying I bonds or bought different amounts over time, then you could have many registrations because each purchase counts as a separate registration.

Only one beneficiary can be assigned to each registration, so if you have multiple individuals whom you would like to have as beneficiaries, then you have to assign each to a different registration(s) in the breakdown that you feel is appropriate. Or, if you have a trust that already accomplishes this for you, you can assign the trust as the beneficiary of all the I bonds.

Changing beneficiaries is cumbersome and must be done individually for each registration on the Treasury Direct site. You can and should assign one or more beneficiaries to each I bond—that way, the bond can be inherited directly without having to go through probate. You can change the beneficiary whenever you want.

Miscellaneous notes

- I bonds are not EE bonds: Make sure you are buying I bonds, not EE savings bonds. EE bonds are the traditional US savings bonds that have a fixed rate, are not adjusted for inflation, and are guaranteed to double in value after 20 years regardless of interest rate. They are currently paying 0.1%.

- Don’t buy I bonds on eBay: The ownership of an I bond is not transferrable. If you buy a $1,000 I bond on an auction site, it is only worth the paper it is printed on (to you) and has already been redeemed or matured.

- I bonds can’t be lost: Your ownership of each I bond is recorded by the government. It can be replaced if forgotten, lost, stolen, or destroyed in a natural disaster.

- Government interest calculator: There is a free government online tool to calculate the current value of all your I bonds.

Wrap-up

I bonds currently make up less than 0.2% of all outstanding US Treasury debt. Until November 2021, when the I bond rate went above 7%, I bonds were not very exciting. But now everyone is talking about I bonds. They aren’t right for everyone, but they can be another tool in your financial toolbox. If you are interested in learning more about how to purchase I bonds or whether they are right for your financial situation, please reach out to our team .

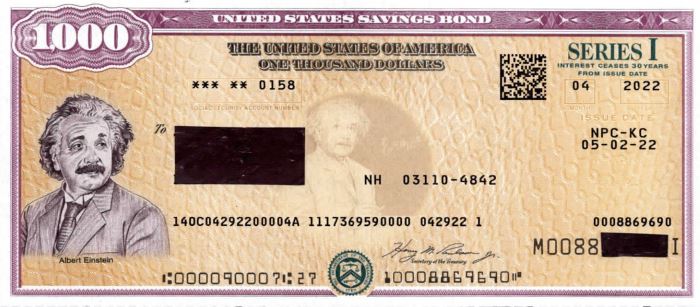

Picture of an I bond issued in 2022 in the $1,000 denomination.

Jonathan Harrington, CFP®, MSFP, MST are advisors at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .