The Inflation Reduction Act of 2022 (IRA), signed into law on August 16, 2022 by President Biden, includes a number of important health, tax and climate change provisions. In this article, we’ll give you a high-level overview of the provisions that impact individuals.

First, a few tax and financial planning-related proposals were not included in the IRA but had been previously floated by the Biden Administration as part of its legislative agenda:

- There was no removal of or increase to the $10,000 state and local tax (SALT) itemized deduction cap for personal income tax returns. As it currently stands, the cap is set to expire in 2025.

- The 3.8% Net Invest Income Tax will not be applied to S-Corp profits.

- There will be no increase in marginal income tax rates.

- There was no impact on the taxpayer’s ability to do backdoor Roth contributions.

Medicare

The IRA included huge changes for Medicare beneficiaries that will significantly help contain out-of-pocket prescription drug prices . A summary of the provisions related to Medicare is listed below.

- Cost sharing for adult vaccines covered under Medicare Part D will be eliminated starting in 2023.

- The price of insulin will be capped at $35 per month starting in 2023.

- The 5% coinsurance above the Part D catastrophic threshold will be eliminated in 2023.

- Out-of-pocket drug spending for beneficiaries in Medicare Part D will be capped at $2,000 annually starting in 2024.

- Drug companies will be required to pay rebates if prices rise faster than inflation for drugs used by Medicare beneficiaries from 2024 to 2029.

- The Health and Human Services Secretary will be required to negotiate prices for the most expensive drugs covered in Medicare starting in 2026. The number of drugs that will be negotiated is cumulative (see chart below).

The Kaiser Family Foundation created the chart below that illustrates all the changes discussed above with a timeline.

Affordable Care Act

The IRA also includes a three-year extension of the enhanced Affordable Care Act subsidies that Congress passed in 2021 as part of the American Rescue Plan Act. That temporary boost increased the premium tax credit amount available to people who buy subsidized health plans in the state-sponsored health insurance exchanges and expanded subsidies to more middle-income people, many of whom were previously priced out of coverage. There is also no income “cliff” once household income reaches 400% of the federal poverty line.

For details on how the subsidies are calculated and paid, please read our blog post from 2021, which covers the calculations in detail . The chart below shows the special enhanced rates as a percentage of income individuals and families must spend on health insurance purchased through an exchange. Notice that the rates for 2021-2022, which have now been extended to 2025, are much lower.

Clean Energy Provisions for Individuals

Energy Efficient Home Improvement Credit

The Nonbusiness Energy Property Credit expired in 2021, but it is being brought back to life in its old form as the Energy Efficient Home Improvement Credit for 2022 only and then significantly expanded for 2023-2032. This nonrefundable tax credit, which started way back in 2005 and has gone through several iterations, is for buying energy-efficient property upgrades for your home, such as windows, doors, insulation, heat pumps and furnaces.

The most significant change is that the credit amount has been increased from a lifetime credit of $500 to an annual credit of up to $1,200 . Certain limits also apply to the credit for purchases of certain types of qualifying property and home audits. See the chart below for a summary of eligible property and item-specific caps.

Purchased items, to qualify for the credit, must meet certain energy efficiency requirements, which are beyond the scope of this article. To make eligibility easier for 2025 and onward, manufacturers of an eligible item will need to create a product identification number for the item, and a person claiming the credit will include this identification number on their tax return.

A few other things to note: 1) The tax credit applies to the year the project was installed; 2) the credit isn’t refundable and can’t generate a tax refund, but it can be carried over to future years to offset future tax liability; and 3) credits for the purchase roofing material will be removed from the Energy Efficient Home Improvement Credit after 2022.

Nonbusiness Energy Property Credit & Energy Efficient Home Improvement Credit Comparison

High-Efficiency Electric Home Rebate Program

The IRA also includes a new program called the High-Efficiency Electric Home Rebate Program. This is not a tax credit but rather a point-of-sale rebate program. The IRA has designated $4.5 billion for the Treasury Department, with the assistance of the states , to develop a program to award rebates to individuals or families who acquire, install or retrofit certain energy-efficient improvements.

To qualify, participants must earn less than 150% of their area’s median income . The percentage of the property’s cost awarded as a rebate will vary based on income. Rebates will be awarded by category (see list below), and each family’s total rebates cannot exceed $14,000 in total. This program will be funded through 2031 and will likely be implemented individually by each state.

List of Eligible Energy-Efficient Improvements:

- $1,750 for a heat pump water heater.

- $8,000 for a heat pump for space heating and cooling.

- $840 for an electric stove, cooktop, range, oven or electric heat pump clothes dryer.

- $4,000 for an electric load service center upgrade.

- $1,600 for insulation, air sealing and ventilation.

- $2,500 for electric wiring.

Residential Clean Energy Credit

This was previously called the Residential Energy Efficient Property Credit but was renamed the Residential Clean Energy Credit as part of the IRA. Most taxpayers know it as the tax credit claimed in connection with solar panels installed at a personal residence or an individual’s investment in a community solar farm. The IRA extends this tax credit through to 2034 and increases the credit amount. The credit had been reduced from 30% to 26% in recent years and was scheduled for further reductions and expiration. The IRA brings this credit back at 30% (for 2022 as well) and extends it for another 10 years through to December 31, 2032, at which point it will be reduced to 26% in 2033 and 22% in 2034.

List of Qualifying Expenses: Solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, qualified biomass fuel property. The IRA added qualified battery storage technology to this list of qualified expenses.

Clean (Electric) Vehicle Credits

For people who are thinking about switching to an electric vehicle, the IRA has changed the current Plug-In Electric Drive Vehicle tax credit for purchasing new electric vehicles and added a tax credit for purchasing used electric vehicles. This credit is effective as of August 16 for new electric vehicles and as of 2023 for used electric vehicles, and it is in effect for both new and used electric vehicles through to 2032.

One big change is that the act removes the prior limitation that only allowed a manufacturer’s first 200,000 electric vehicles to qualify for tax credits. This change allows Tesla and GM , which have already passed the 200,000 cap, to have their vehicles qualify again.

For new electric vehicles, the maximum amount of the credit stays the same at $7,500, and for used electric vehicles, the maximum credit is $4,000 . Both come with serious caveats (discussed below) about which taxpayers and which vehicles qualify.

New Clean (Electric) Vehicle Qualifications

The tax credits are designed to incentivize automakers to shift battery metals extraction and processing as well as vehicle assembly to North America and to reduce reliance on certain foreign countries for critical minerals and battery components. According to the Alliance for Automotive Innovation, no electric vehicles available for purchase today will qualify for the full tax credit in 2023 . But if manufacturers believe that this tax credit will be an incentive for electric vehicle purchases, they should be incentivized to adjust their manufacturing and material sourcing practices so that more of their vehicles qualify for the tax credit.

- Final Assembly Test: The final assembly of the vehicle must occur in North America. Currently, there are only about 30 vehicles that qualify under this test. If the vehicle does not meet this qualification, it is not eligible for any part of the credit.

- Vehicle Manufacturer’s Suggested Retail Price (MSRP) Caps: The price of the vehicle cannot exceed certain limitations (see below) in order to qualify for the credit.

- Vans, SUVs, pickup trucks: MSRP of $80,000

- Any other vehicle, including cars: MSRP of $55,000

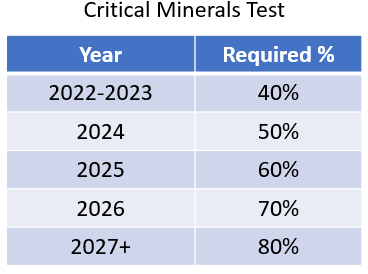

- Critical Minerals Test: A required percentage of critical minerals used in the vehicle must have been extracted or processed in the United States , or in a country with which the United States has a free trade agreement , or have been recycled in North America . See the chart below. If the electric vehicle qualifies under this test, it is eligible for $3,750 of the maximum $7,500 tax credit.

- Battery Components Test: A required percentage of the battery components for the vehicle must also have been manufactured or assembled in North America. See the chart below. If the electric vehicle qualifies under this test, it is eligible for $3,750 of the maximum $7,500 tax credit.

Taxpayer Qualifications for New Clean (Electric) Vehicles

If the new electric vehicle qualifies for a full or partial credit based on the four-pronged test detailed above, the taxpayer must also qualify for the credit based on the criteria below.

- The credit is not allowed for taxpayers whose modified adjusted gross income (MAGI) exceeds the thresholds below. Note: Temporary transition rules published by the IRS indicate that the income limitations do not apply until 2023, allowing a brief window for higher-income purchasers to still claim the credit until December 31, 2022. As it stands now, the income qualifications are a cliff, meaning if the taxpayer(s) are $1 over the thresholds presented below, they will not qualify for any part of the credit.

- Single: $150,000

- Joint: $300,000

- Head of Household: $225,000

- The credit is allowed once per vehicle and contains a requirement that the taxpayer include the vehicle identification number on the filed tax return in order to qualify for the credit.

For 2022 and 2023, the credits are claimed as part of a purchaser’s annual individual income tax return filing. Starting in 2024, this will change with the credits becoming transferrable to vehicle dealers so that they can offer a discount on the price of the vehicle at the time of sale rather than requiring buyers to pay up front and then wait for a refund when they file their Form 1040 the following year. It will be interesting to see how the dealers will be able to qualify buyers on the income tests at the dealership.

Special Transition Rules for a 2022 New Clean (Electric) Vehicle Purchase

Individuals purchasing a new electric vehicle in 2022 have a temporary window through December 31, 2022, where they can choose to apply the old or new credit rules to their purchase.

Individuals who purchased an electric vehicle and placed it in service before August 16 are subject to the former Plug-In Electric Drive Vehicle tax credit .

Individuals who purchased an electric vehicle or entered into a written, binding contract to purchase a clean vehicle between January 1 and August 15, 2022, but placed it in service on or after August 16 can elect to have the former Plug-In Electric Drive Vehicle tax credit rules apply to that vehicle. The final assembly test (see above) does not apply.

Individuals who purchase an electric vehicle from August 16 and place it in service prior to January 1, 2023, are subject to the final assembly test (see above) but are not subject to the MSRP caps, the critical minerals test, the battery components test or the modified adjusted gross income limitations.

These special transition rules may encourage an individual interested in electric vehicles manufactured in North America to consider a purchase before January 1, after which the more demanding requirements begin, as long as they can place the vehicle into service before January 1.

Previously Owned (Used) Clean (Electric) Vehicles

As mentioned, the IRA creates a new $4,000 credit for used electric vehicle purchases starting in 2023. For now, the used electric vehicle does not need to meet the final assembly test, the critical minerals test or the battery components test. The used electric vehicle would need to meet the qualified vehicle rules of the Plug-In Electric Drive Vehicle tax credit to qualify. The maximum credit would be $4,000 or 30% of the cost of purchasing a used electric vehicle, whichever is less. There are also a number of additional caveats for used vehicles, which are listed below.

- The used electric vehicle cannot exceed $25,000 in price .

- The used electric vehicle must be a model year that is two years earlier than the current calendar year.

- The used electric vehicle must be purchased from a licensed auto dealer .

- The used electric vehicle must be purchased for personal use and not for resale.

- The taxpayer(s) claiming the credit must not have been allowed a previous used electric vehicle credit for any sale during the three-year period ending on the date of the purchase of the used electric vehicle.

- The sale must be the first transfer since the enactment of the IRA to a qualified buyer other than the person with whom the original use of the vehicle commenced.

There are also modified adjusted gross income limitations for the used electric vehicle credit, which are exactly half of the limitations for the new electric vehicle credit.

- Single: $75,000

- Joint: $150,000

- Head of Household: $112,500

https://www.bnncpa.com/resources/green-energy-incentives-in-the-inflation-reduction-act-of-2022/ The used electric vehicle credit is allowed once per vehicle and includes a requirement that the taxpayer include the vehicle identification number on the filed tax return in order to qualify for the credit.

Summary

The Inflation Reduction Act will undoubtedly provide financial benefits to many Americans. As with any new legislation, it is important to understand the details and how they might affect you personally. In the case of the IRA, most of the provisions that affect individuals are positive and can lead to significant savings on prescription drugs for those enrolled in Medicare, premium subsidies for those getting insurance through a state exchange, and tax credits and rebates for buying energy-efficient items for your home or an electric vehicle. If you need help with understanding how the IRA might benefit you, please reach out to our team .

Jonathan Harrington, CFP®, MSFP, MST are advisors at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .

Source:

Source: