Your Rate of Savings Is More Important Than Your Rate of Return

When trying to save, many people look at how much their investment is growing based on their rate of return. However, the rate of return only matters when there are enough savings for it to grow. Instead of waiting for it to grow slowly, from the ground up, it’s a lot more efficient to build on that growth by continuing to save. Your rate of saving is the most important factor in determining how long it’ll take you to reach your financial goals. By increasing your savings rate, the amount you get in return will grow exponentially even if the rate of return stays the same.

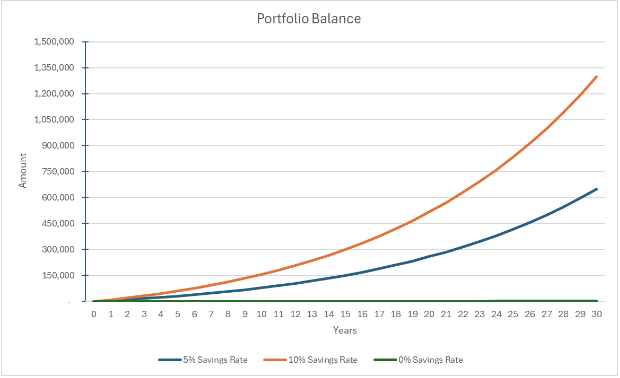

For example: Three people start saving at the same time. They each earn $100,000 in income, which grows at 3% each year. One person saves 5% of their income each year, another saves 10% each year, and the last person doesn’t save anything. They each put an initial investment amount of $100 into their accounts. Assuming a rate of return of 7% each year, after 30 years the accrued amount in each person’s portfolio would be drastically different. Below is a graph depicting the growth/change of each person’s portfolio based on these circumstances. The portfolio of the person who saved 5% grew to roughly $650,000. The portfolio of the person who saved 10% grew to roughly $1,300,000. And the portfolio of the person who didn’t save anything only grew to $1,750.

Rate of return shows how well your investment is doing as a percentage increase or decrease. It’s the measurement of how much money you’ve made or lost on an investment in comparison to the original amount you put in. Savings rate is the portion of income that you save rather than spend, shown as a percentage. Both factors have a great effect on how your portfolio grows and performs. If you want to learn more about other factors affecting your portfolio and investments, check out our blog “Is the Stock Market Overvalued and Does It Matter?”

A big difference between your rate of savings and your rate of return is that you have control over how much you can save, while you can’t control returns. Early on, your savings rate is more crucial than your return, but as you get closer to retirement, your rate of return comes more in to play. There’s no shortcut to reaching your financial goals. Consistently saving every month and every year will have a much bigger impact than reaching another percentage of return on your investments. If you’re unsure about how you’ll be able to save and reach your financial goals in your current situation, check out another one of our blogs “How to Be Financially Healthy.”

Saving money can be complicated. You don’t have to do it alone. If you need assistance with saving money as a part of your overall financial planning, please reach out to our team.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.