If you're 65 or older, by now you should have received your annual installment of the official U.S. government Medicare handbook, Medicare & You 2026. Your mailbox is also probably full of Medicare Advantage-related flyers from insurance companies trying to win your business.

The annual open enrollment period for Medicare started on October 15 and lasts until December 7. It is the one time every year that Medicare beneficiaries have an opportunity to modify their Medicare coverage. During the open enrollment period, you can switch or add a Medicare Advantage plan, switch to or add a Part D prescription drug plan, and, in some states, including Massachusetts, switch from an Advantage to a Medigap plan. Any changes you make will take effect on January 1 of next year.

So many changes are coming for 2026, especially for Medicare Part D plans. It's always important to review your prescription drug plan during Medicare's open enrollment period, but this year, there are more changes than we've seen in a long time. You're likely to be affected by the changes, and if you don't do the research, you're going to be stuck paying more for your drug coverage than you should. Do not assume that the plans you had last year will be the best plan for you next year.

This blog post cannot cover everything that you will find in the 128-page Medicare & You 2026 handbook, but we'll cover the basics to give you a general understanding of Medicare and your options during the open enrollment period. Some 2026 amounts (premiums, deductibles, and out-of-pocket maximums) have not been issued yet.

Significant Changes for 2026

Several major insurers have announced cuts in or elimination of commissions paid to independent agents and brokers for enrolling beneficiaries in certain Medicare Advantage and Part D prescription drug plans. This shift impacts the industry greatly, resulting in independent brokers dropping plans or exiting the market. Agents may not recommend the lowest-cost or the best-fit plan if it is outside their covered network.

Advantage plan network changes make the choice of provider a key factor to weigh. Across the United States, Advantage plan enrollees had access to 50% of the doctors available to those on traditional Medicare.

Some Medicare Part D insurers are pulling out of the market entirely. In Massachusetts, there are 14 plans in 2025, but there will be only 11 in 2026. If you have a stand-alone Part D plan in 2025 that is discontinued for 2026, you must find a new Part D plan during open enrollment!

The drugs an insurer covers under their plan (the "formulary") will be different. Expect fewer drugs to be included in each insurer's plan. Some drugs may now be more expensive, while others could be less.

You may have heard that out of pocket costs are now capped for Medicare recipients. The out-of-pocket cap only applies to the cost of drugs included in each Part D plan's approved list of their covered drugs. There are many drugs that aren't covered by this cap. Check your drug pricing tier for premiums and drugs that are not covered.

As a result of corporate mergers and sales, the name of the plan may have changed. For example, Cigna has changed to HealthSpring.

Pharmacy choice matters. Typically, you get the best prices when a pharmacy is "preferred, in-network", not just in-network. The in-network pharmacies are different depending on which plan you choose.

While preferred in-network pharmacies are the cheapest, plain in-network pharmacies are still less expensive than out of network pharmacies, which are usually the most expensive. Mail order can be a cost-effective option.

Part B (medical insurance) premiums are expected to rise by 12% in 2026. Budgets and financial plans should be updated.

Medicare in General

Navigating Medicare and all its parts can be confusing, mainly because of the difficulty in understanding the differences between Medicare Part C, aka Medicare Advantage, and Medigap, aka Medicare supplemental insurance. Let's begin with a summary of each of the parts of Medicare.

Part A: Covers the cost of inpatient care in hospitals, skilled nursing facilities, and hospice and home health care. Part A coverage is free if you or a current or former spouse paid Medicare taxes for 40 or more quarters while you were working. If you did not, the monthly premium for Part A ranges from $285 to $518 in 2025. The deductible for Part A is $1,676 in 2025, and then you pay coinsurance for additional days spent in the hospital, at a skilled nursing facility, or while in hospice or using home health care.

Part B: Covers the services necessary to diagnose and treat medical conditions, including doctor visits, outpatient care, emergency department care, preventive care, and vaccinations. The standard premium in 2025 is $185 a month but could be higher if you are subject to an Income-Related Monthly Adjustment Amount (IRMAA) surcharge or a late enrollment penalty. The deductible for Part B in 2025 is $257. After you meet the deductible, you pay 20% coinsurance of the Medicare-approved amount for the coverage that you receive.

Part C: Part C is also known as Medicare Advantage, and it is an all-in-one alternative to Original Medicare offered by private insurance companies approved by Medicare. Medicare Part A and Part B, and typically Part D, are rolled into one plan administered by a private insurance company. In Part C, the Part A and Part B deductibles and coinsurance are replaced with the private insurance company's own deductibles, copays, coinsurance, and out-of-pocket limits. Beware of coverage limitations when choosing a Medicare Advantage plan.

Part D: This covers prescription drugs. Premiums vary based on the insurer providing the coverage and the plan selected — there's more to come on that below — and you could be subject to an IRMAA surcharge. The deductible for Part D varies by plan but will not exceed $590 in 2025. After you have paid the deductible, you will start paying copays for your prescriptions. Since January 1, 2025, Medicare Part D has had a hard annual cap of $2,000 ($2,100 for 2026) on out-of-pocket prescription drug costs, and insulin costs are capped at $35 a day. Please be aware that this new $35 insulin cap applies to "covered" medication and not every insulin product is included. Some large national Part D carriers have restructured their formularies to narrow insulin brand options, and the $2,000-per-year cap does not apply to drugs provided as part of outpatient care, such as drugs administered at a dialysis facility or certain cancer drugs such as orally administered chemotherapy. It also only applies to drugs covered by Medicare. Not all generic drugs are covered, so an individual's drug costs can easily exceed the $2,000.

Another important fact is that noncovered pharmacies are not included in the above caps. Whether or not your pharmacy is covered can change from year to year. Do your research!

Medigap

Medigap coverage is aptly named, because it fills in the deductible and coinsurance gaps of Medicare Part A and Part B. In most states, there are 10 Medigap plans, while some other states, including Massachusetts, have three different plans.

Medicare Advantage

Medicare Advantage Plans (Medicare Part C) Overview

Medicare Advantage is a Medicare-approved plan from a private insurance company that offers an alternative to original Medicare for your health and drug coverage. These "bundled" plans include Part A, Part B, and usually Part D. Plans may have lower out-of-pocket costs than only using Medicare Part A and Part B, but if you enroll in a Medicare Advantage plan, you will need to use doctors and medical providers that are in the plan's network, and you may need a referral to see a specialist. Medicare Advantage plans may also offer some extra benefits that don't come with Part A and Part B, including vision, fitness, hearing, and dental services.

Some Medicare Advantage plans have a health maintenance organization (HMO) base, while others are based on HMO point of service (HMO-POS), a preferred provider organization, or private fee-for-service plans. The differences between these types of plans are beyond the scope of this blog post. When selecting a type of plan, you'll want to be sure you're comfortable with the network and its coverage area, the requirements for preapproval and approvals from a primary care physician, and the out-of-network coverage rules.

Medicare Advantage plans can look attractive to people who are new to Medicare, are healthy, and don't think they'll need much medical care. However, as you get older and require more medical care, the cost of these plans can become high and unpredictable because you're subject to coinsurance amounts up to the annual out-of-pocket limits, which can be significant and comparable to individual health plan amounts.

Zero-Premium Advantage Plans

If you're searching for Medicare Advantage plans, you may find some have very low or even no premiums. How is this possible? Medicare pays insurance companies up to $1,000 a month for the privilege of managing your health care needs, so the insurance company has an incentive of low or no premiums to entice you to join its plan. Even if you choose a zero-premium Medicare Advantage plan, you will likely still have to pay the Part B premium and the Part A premium if you don't have premium-free Part A.

Not all doctors, specialists, or hospitals take these plans. Your plan can be canceled at any time. You are subject to copays and other usage costs. The total in-network out-of-pocket maximum is $9,350 and the out-of-network maximum is $14,000 per year in 2025. You cannot switch from Medicare Advantage to Medigap in most states, though you can in Massachusetts, Connecticut, Maine, and New York.

Medicare Advantage plans are aggressively marketed. Medicare pays brokers who sell them three times as much in commissions as for a Medigap plan. In fact, some members of Congress have proposed renaming Medicare Advantage "Alternative Private Health Plan" to eliminate confusion. Medicare Advantage is not Medicare.

Medicare Advantage Open Enrollment

If you are or want to be covered by a Medicare Advantage plan, during open enrollment you can review all the Advantage plans that are available to you where you live. You can go to the Medicare Plan Finder to review the Advantage plans available in your area.

Medicare Advantage users also have an additional Medicare Advantage open enrollment period from January 1 through March 31 each year that allows users to switch Medicare Advantage plans or disenroll from their current plan. It's sort of like a second look. You can also switch to a five-star rated Medicare Advantage plan outside the other open enrollment periods once per year.

Medigap

Medigap Overview

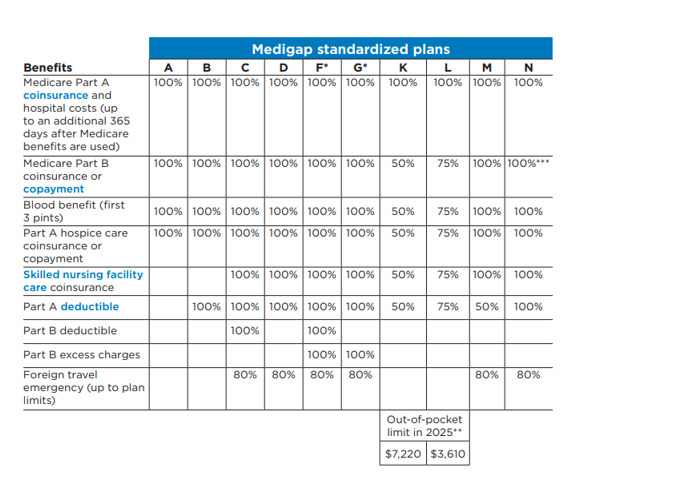

A Medigap policy is coverage administered by private insurance companies. It helps cover the gaps in coverage of Medicare Part A (hospital insurance) and Part B (medical insurance). These costs include deductibles, copayments, and coinsurance for medical services. There are currently 10 different standardized Medigap plans — see the chart below — and each one covers different types of costs. Not all insurance companies offer each type of plan, and the most popular are plans G and N, which account for over two-thirds of traditional Medicare supplement plans sold.

Massachusetts has three Medigap plans: Core Plan, Supplement 1, and Supplement 1A. Supplement 1A is like Plan G.

To purchase a Medigap policy, you must have Medicare Part A and Part B. Different companies charge different premiums for the exact same coverage. As a result, once you determine which Medigap benefits you want, you can determine which policy to buy based on the company and the price.

Medigap plans offer cost predictability, because if you choose Medigap Plan G, all out-of-pocket costs except for the Part B deductible of $257 (for 2025) are covered. So, your total out-of-pocket costs for a given year are limited to the plan premiums plus $257. This also includes any excess charges that private medical providers that do not accept Medicare can charge; they're limited to 15% above Medicare rates.

With Medigap plans, there is no network and there is no requirement for referrals, so you can get medical care from any public hospital in the country and from most private hospitals. This is especially important for patients who travel (think snowbirds) or want to seek medical care in areas that would be out of network with their Medicare Advantage plan. Medigap plans are portable and can be continued if you move to a new state.

Medigap plans do not include prescription drug coverage, so you will need to purchase a stand-alone Part D prescription drug plan.

Chart taken from the Medicare & You 2026 guide

Medigap Plan Open Enrollment

Only in specific and limited circumstances do you have a guaranteed issue right to purchase a Medigap policy, which means that you might not be able to change Medigap policies during open enrollment. This means that the policy you purchase during your Medigap open enrollment period when you turn 65 may be the policy you have for the rest of your life.

The best time to buy a Medigap policy is during the Medigap open enrollment period, which begins on the first day of the month in which you are 65 or older and enrolled in Part B. If you do try to switch during the annual Medicare open enrollment period, you will likely be subject to medical underwriting. However, it does not hurt to weigh your options if you want to switch to Medigap from Medicare Advantage or switch Medigap plans.

In Massachusetts, where Medigap plans are called CORE, Supplement 1, and Supplement 1A, residents have an annual opportunity to enroll in Medigap with guaranteed issue. This special rule is only available in Massachusetts, Connecticut, and New York; and in Massachusetts, it is available from February 1 to March 31 every year. Premiums for Medigap policies are community rated, which means that all members of each plan pay the same premiums. The premiums are not reflective of age.

Thirteen states allow you to switch Medigap plans around your birthday with no medical underwriting, but only to plans with similar or less coverage.

In most states, you cannot switch Medigap plans after the Medigap open enrollment period without going through medical underwriting, which means that there is no guaranteed issue. There are a few exceptions to this, including if your Medicare Advantage plan discontinues coverage in your area, if you move to an area where your Medicare Advantage plan has no coverage, and if your Medigap or Medicare Advantage plan goes bankrupt.

Part D

Prescription Part D Coverage Overview

Medicare Part D is drug coverage provided and administered by private insurance companies. Part D covers brand-name and generic prescription medications and insulin. Each plan determines the medications it will cover and the costs associated with each medication.

Part D Open Enrollment

Your first consideration when selecting a Part D plan is to see whether the plan covers the medications you need. You want to look at the plan's coverage rules, specifically the quantity limit and need for prior authorization. Check out the plan's network of preferred pharmacies because you will likely pay less for medications dispensed at a preferred pharmacy than you will at a standard network pharmacy.

Next, look at all the plan costs, including the monthly premiums, deductibles, copayments, and coinsurance. You will also want to understand whether the plan will require you to use generics, even if you know the brand name or specialty drug is more effective for you personally. Finally, check to see whether your doctor will need prior authorization from the insurance company before writing the prescription. This administrative requirement may disrupt your regular usage of a particular drug.

It is also important to note that even if you do not take medications, you should still consider enrolling in a Part D plan. If you do not, you will be assessed a late-enrollment penalty if/when you next sign up for a Part D plan. The penalty is a surcharge of 1% for every month that you were eligible but not covered.

Comparing Plans

The best resource for comparing Medicare Advantage and Part D prescription drug plans is the Medicare.gov plan finder. When using the tool, you'll want to collect information related to the prescription drugs and the pharmacies that you use, because they drive a large portion of your out-of-pocket costs. You also need the dosage and frequency of ALL your prescriptions, because the more accurate you are with this information, the more precise the estimate of your out-of-pocket costs will be.

HeyMOE is a clean, easy-to-use application that analyzes Part D options for a $30 per year subscription fee. HeyMOE—Medicare Part D Open Enrollment Automatic Comparison Tool | Simplify Medicare Plans Today

You do not want to assume that the Medicare Advantage or Part D prescription drug plan that you had this year is going to be the best plan for next year. Any part of the plan, including the premiums, deductibles, copays, coinsurance, out-of-pocket limits, and prescription drug coverages, can change from year to year, so you have to do your homework and review your options each year.

It is important to remember that your health coverage preferences are unique and a plan that works for you may not work for someone else. You need to evaluate plans and coverage based on your own individual health, lifestyle, health care usage, preferences, and ability to pay premiums.

You may also want to look at each plan's star ratings, which indicate the overall satisfaction of current and past plan participants.

We suggest you meet with a qualified Medicare representative along with your financial advisor to determine which Medicare plan is right for you. You can also check out our recent webinar with Medicare maven Marcia Mantell here for additional information.

Choosing the right Medicare supplement plan can be challenging, but you don't have to navigate it alone. A financial advisor can provide you resources for evaluating Medicare plans; help you stay informed about tax law changes; optimize your savings and investments; and avoid costly mistakes. If you need tailored guidance, our team is here to help. Reach out to us at (603) 589-8010 to integrate tax planning into your investment management and overall financial strategy.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.