As the markets have been doing well this year, it is now time to revisit a concern that often comes up in times of market growth: Are the markets overvalued?

Whenever you see this question, or the comment that “markets are at a high,” the questions to ask should be:

- What are the alternatives?

- How are you defining overvaluation?

- Have you found valuation to be an effective market timing tool?

Honestly, most people decide that the alternative to investing in stocks is inaction, leaving cash in checking/savings accounts instead. This is almost certainly an idea that will leave you with less money in spending power over the years.

There is no consistent measure of “overvaluation.” (PE ratios? Absolute basis? Relative to gold? Bitcoin to US dollar?)

The great investor (and Warren Buffett’s teacher) Benjamin Graham said, “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

There has never been an effective market timing tool, ever in history. This is because to win the market timing game, you must know when to get OUT of stocks and when to get back IN again. This is so hard to do that no one can do it consistently over time.

Let’s consider the biggest risk to your portfolio (and no, it’s not temporary volatility): inflation. The rising cost of living. The cost of a postage stamp 30 years ago versus today.

Will your annuity payment of $2,500/month cover your increase in living expenses over 30 years?

Most retirees want an income that grows, similar to when they were working. Which would you rather own – an investment that grows at a rate that is less than the current inflation rate or one that pays a variable rate that grows over your retirement period at a rate much greater than the inflation rate over the long term? I know which one I would want.

Therefore, what is the alternative to a diversified investment portfolio that emphasizes stocks?

Note that stocks are long-term investments designed for holding periods of five years or longer. Short-term money should be held in savings accounts or money market funds. The current rates on these accounts may be as high as 5% as of July 2024 (which sounds like a lot, until you compare that to the increase in your food bill over the past year).

Let’s look back at March 2000, another time when markets were considered overvalued and right before the dot-com bust. A portfolio of $100,000 invested in the S&P 500 then, left to compound, would be worth roughly $500,000 dollars today, despite the roughly halving of the markets that has happened twice since then.

Compounding is the secret weapon to growing wealth. As Charlie Munger once said, “The first rule of compounding is never to interrupt it unnecessarily.” Mindless panic is a major destroyer of invested wealth, with performance chasing a close second.

What about all the pundits predicting doom and gloom? I won’t promote any of those people here, as their “advice” is nothing but clickbait and scare tactics to get you to buy their books.

Helpful financial advice should not try to scare you. It should offer perspective, not predictions. Its purpose should be to help you reach your long-term goals. Helpful advice provides clear, actionable steps to better your financial condition. Often these are in the form of habits, not market-timing madness. For example:

- Spend less than you make.

- Save aggressively.

- If you are young, your future income is your largest asset. Improve your skills.

- Invest early and often.

- Invest in stocks for maximum wealth creation.

- Keep a cash reserve fund for emergencies (job loss, basement flooding, etc.).

- Don’t react to current events. You can’t make good investment policy out of them.

- Understand your tax situation.

- Understand your investment asset allocation.

- Control your risk, including risk of death, disability, divorce and unforeseen events.

If you don’t have the discipline, desire or knowledge to do the above, enlist the help of a financial advisor. And stay away from the doom-and-gloomers, who are usually known for being right once in a row.

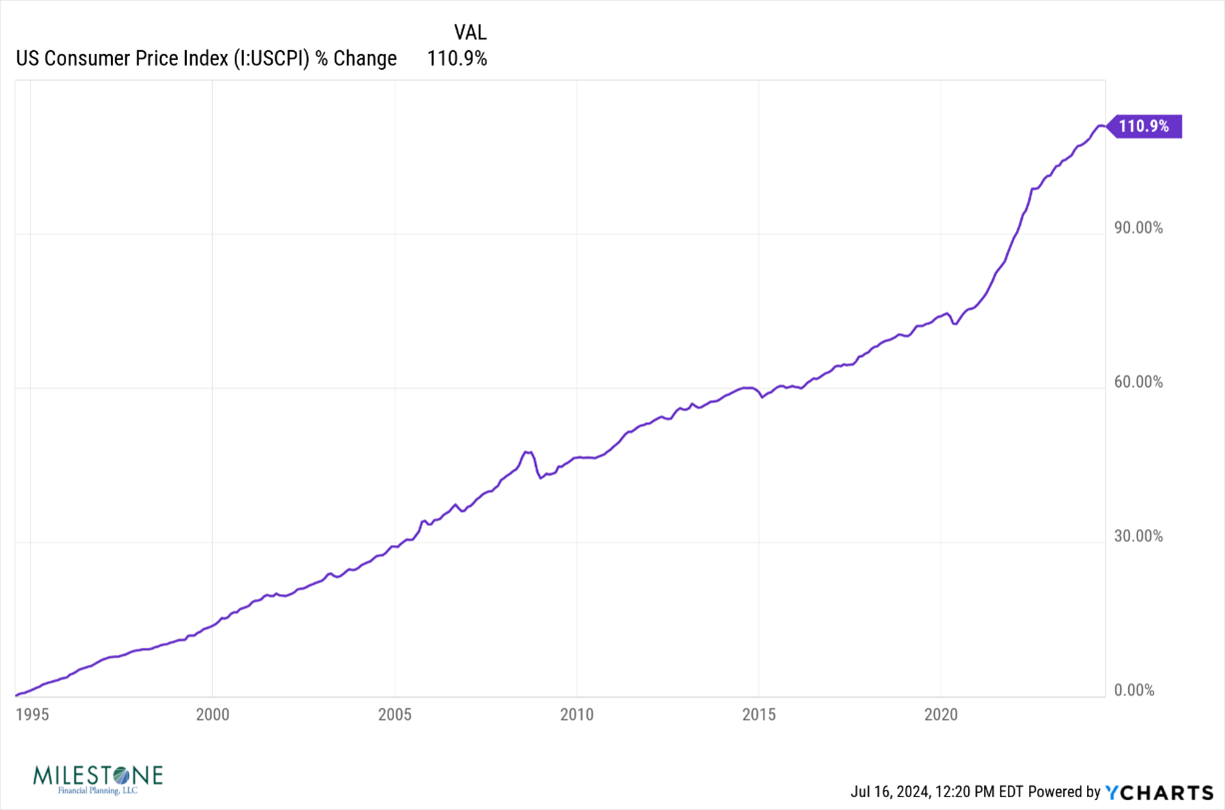

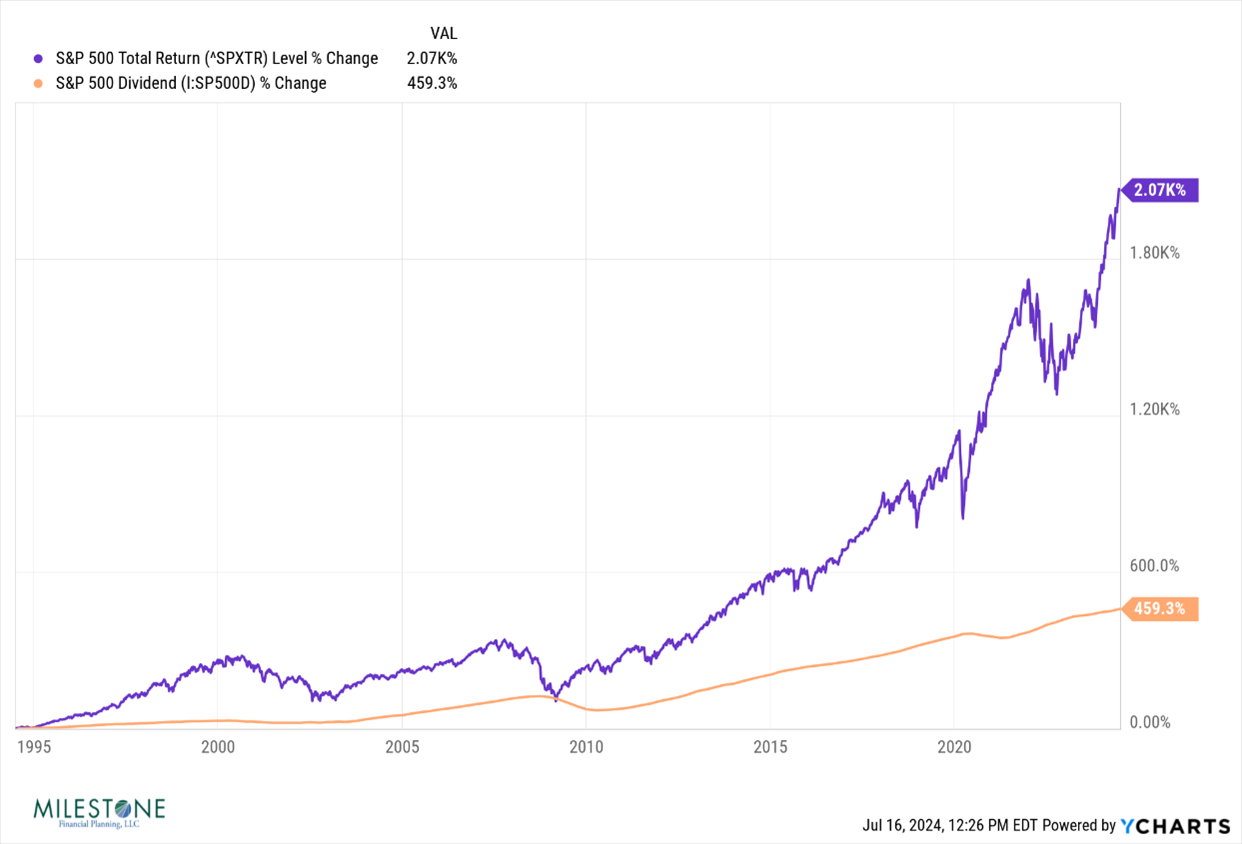

I could show you a chart that demonstrates that the US large company stocks as a group have positive returns 75% of the time over one-year periods and 100% of the time over 20-year periods. Or that even though the S&P 500 has halved three times in the past century, the longest it has taken to recover with reinvested dividends has been a little more than five years. However, those sorts of statistics can be mind-numbing and not necessarily reassuring. Let’s look at a simple chart that focuses on the real risk to your financial planning: the ever-rising cost of living, as evidenced by a statistic known as the Consumer Price Index (CPI). Just in the past 30 years, the CPI has increased 111%. This is over a period that had lower-than-average inflation for many years.

In contrast, S&P 500 dividends have increased 459%, and the S&P 500 itself (dividends reinvested) has increased roughly 2,070% in the past 30 years.

This means that $100,000 invested into the S&P 500 in 1994 has increased to $2,170,000 (with dividends reinvested), and the dividends paid on that increased from $2,820 to $15,760. (Note that past performance does not predict future results, and we would not suggest you put all your money in the S&P 500!)

One historically significant example of inflation is the postage stamp, which cost 29 cents 30 years ago (1994). The current cost of 73 cents means that the price of stamps has outpaced inflation by almost 30 percent. Even assuming your retirement expenses only increased by the CPI in the past 30 years, if your $2,500 annuity payment in 1994 covered your then-current expenses, how would you afford monthly expenses of $5,275 in 2024?

You can see from the above that a portfolio that includes stocks might help mitigate the risk of inflation over a typical 30-year retirement.

(Note: data as of July 2024)

What will the next 30 years (encompassing your retirement) bring?

There are no facts about the future; past performance does not predict future results, and that is GREAT for your investment portfolio. It is because we accept volatility that we can experience the outsized returns of stocks. One philosophy is to save 20%-30% of your income and own as many stocks (spread over many sectors and countries) as your financial plan and risk tolerance can support. You would not be led astray by this approach. As everyone’s circumstances vary and past returns do not predict future results, check with an experienced and credentialed financial advisor to review your financial and tax situation before you act.

Stock returns are sometimes referred to as “volatile.” Another way to phrase this is “random.” While the long-term rate of return for the S&P 500 has consistently been about 10%, only seven out of the past 98 years showed returns within 2 percentage points of that range (that is, annual returns of 8%-12%). Returns are much more volatile than that, ranging from a high of 54% to a low of −43%. To achieve those market returns of 10%/year in the long term, we must accept the volatility of the markets. This volatility can be mitigated by diversifying among asset classes and keeping the assets you need in the next few years held in cash and bonds.

As evidenced by numerous charts and graphs in Jeremy Siegel’s classic, Stocks for the Long Run, the path to build wealth is to continually buy and keep stocks. We would further refine that to craft a diversified portfolio appropriate to fuel your financial plan, which is designed to accomplish your goals.

Investment markets are complex. It is easy to become overwhelmed with financial decisions and even to turn away from investing altogether, even though it is one of the best time-tested ways to grow wealth. Thankfully, you do not need to digest market developments and make investment decisions on your own. With decades of experience among our team members, we are here to help you reap the rewards of investing in markets while intelligently managing risk. If you would like to discuss your individual circumstances and how we can help, please reach out to our team.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.