It is commonly agreed that one of the main pillars of prudent investing is diversifying your investments. While most investors will agree with that statement, not every investor believes in including an international allocation in their portfolios because of recent U.S. outperformance relative to the rest of the world’s developed markets.

Using Vanguard index funds as a proxy, as of June 23, 2025, the Vanguard 500 Index Admiral (VFIAX) returned an average of 12.94% a year over the past 10 years, while the Vanguard Total International Stock Index Admiral (VTIAX) only returned an average of 5.60% a year.

However, more recently, international stocks have outperformed. In 2025 year-to-date returns, VTIAX is up 14.7%, while VFIAX is only up 3.1%. This shift is already changing the narrative and underscores why exposure to foreign stocks still plays a critical role in long-term success.

Beyond the S&P 500

For U.S. investors, international stocks from the rest of the world’s developed economies, like Canada, Japan, Australia and Europe, are combined into one basket of securities called “International Developed.” International stocks from emerging economies in countries like China, India, Korea and Taiwan are grouped into another basket, called “Emerging Markets.” The available investment universe in these two baskets is roughly half the size in terms of market capitalization as the total U.S. market (see chart below). Investors should want access to these other baskets for diversification purposes, particularly when building a well-rounded international investment portfolio.

Total market cap, as of December 31, 2024

In USD. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2024, all rights reserved.

The Case for International Stocks: The US Underperforms

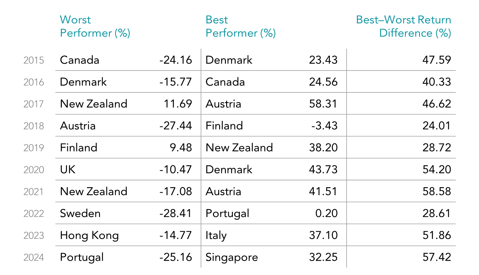

To highlight the variance of returns between the world’s developed markets and a reason to stay diversified, review the chart below, which shows the best- and worst-performing markets from 2015 to 2024. Despite the strong stock market performance in the U.S. over the past 10 years, the country was not the highest-performing developed market in any of those 10 years.

The randomness of global stock returns makes it difficult to figure out which markets are likely to be high performers in the future. Holding equities from developed markets around the world positions investors to potentially capture higher returns where and when they appear, and outperformance in one market can help offset lower returns in another. A globally diversified portfolio can provide more reliable outcomes over time.

Some investors question whether investing in international stocks provides meaningful diversification, given that correlations between the U.S. and international markets have increased over the past few decades. It is true that major economic events often cause international and U.S. market trends to follow one another, which can reduce the diversification benefit in the short-term. However, the U.S. and international markets are not perfectly correlated. Sector exposure, currency exchange trends, and different economic cycles allow international stocks to help reduce overall risk in a portfolio and create more consistent outcomes in the long-term.

Best- and Worst-Performing Countries (%): 2015-2024

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. In USD. MSCI country indices (net dividends) for each country listed. Does not include Israel, which MSCI classified as an emerging market prior to May 2010. MSCI data © MSCI 2025, all rights reserved.

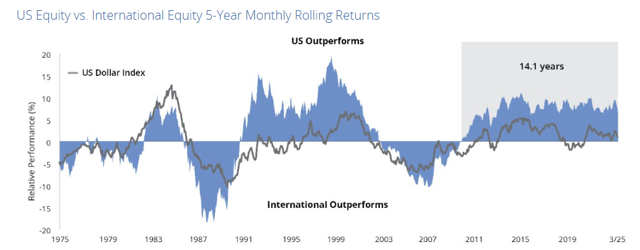

US and International Outperformance Tend to Come in Cycles

While this past decade has shown U.S. stocks outperforming international stocks as a whole, this has not always been the case. In fact, the out- and underperformance of foreign stocks tend to come in cycles. Over the past 50+ years, there have been numerous periods of foreign outperformance (in terms of 5-year monthly rolling returns) compared to U.S. stocks (see the chart from Hartford Funds below).

This latest period of U.S. outperformance has been one of the longest in history, but that does not necessarily mean it will continue forever. Fiscal stimulus through increased defense spending in Europe, better economic cohesion across Europe post-Brexit, and China searching for non-U.S. trading partners could act as market tailwind for non-U.S. stocks in the next decade.

Chart Data: 1/31/75-3/31/25. The chart shows the values of the S&P 500 Index’s returns minus the MSCI World ex USA Index’s returns. When the line is above 0, domestic stocks outperformed international stocks. When the line is below 0, international stocks outperformed domestic stocks.

Data Sources: Morningstar, Bloomberg, and Hartford Funds, 4/25.

Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. The performance shown above is index performance and not representative of any of Hartford Fund’s performance. U.S. equity is represented by the S&P 500 Index; international equity is represented by the MSCI World ex USA Index. For illustrative purposes only.

Final Thoughts: Should You Invest in International Stocks?

U.S. investors tend to concentrate their portfolios in favor of the U.S. market, at the expense of global diversification. In different market environments, and as sentiments about global diversification and its value ebb and flow, it is helpful to remember that history has not shown any one market around the world to be a consistent outperformer. Diversification is a vital aspect of any proper investment portfolio, and having exposure to stocks from markets around the world helps reduce risk while increasing expected returns.

Whether or not to invest internationally ultimately depends on many personal factors, including goals, risk tolerance, and broader portfolio strategy. Investing can be complex, especially when it comes to determining the appropriate amount of international exposure. A financial advisor can help you manage your investments, stay informed about tax law changes, optimize your savings, and avoid costly mistakes. If you need tailored guidance, our team is here to help. Reach out to us at (603) 589-8010 to integrate tax planning into your comprehensive financial strategy.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure.