As financial planners, we obviously adore retirement accounts and saving for the future. What makes these accounts so great is the tax rules associated with contributing money to them. You can either get a tax deduction today (but pay taxes later when you withdraw the money) or skip the deduction now and know that the money invested will grow tax-free going forward.

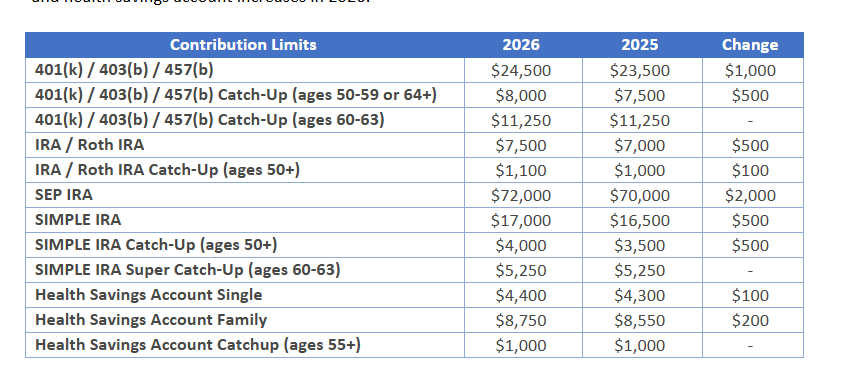

The tax benefits are so appealing that there are contribution limits to these various retirement and health savings accounts. Every year, the IRS reviews these limits, and financial planners everywhere wait with great anticipation to find out whether these limits will increase in the coming year. The numbers for 2026 are out, and several contributions will be increasing. When these limits increase, it's a good idea to review your paycheck deductions or budget in general and adjust your contributions to ensure you're maximizing the tax benefits of these accounts. Here's what you should know about retirement and health savings account increases in 2026:

401(k) Contribution Limits for 2026

For many individuals, the best option they have for saving for retirement is through their workplace plan, like a 401(k) or 403(b). A part of what makes these accounts so valuable is that it takes much of the manual effort of making a contribution out of the equation. You simply tell your payroll department how much you want to contribute and the deduction is taken out of your paycheck automatically without you having to do anything. Often in finance, and in life in general, the path of least resistance is the best way to ensure something gets done — like saving for retirement.

For 2026, 401(k) contribution limits are increasing by $1,000, from $23,500 annually to $24,500. Those who will be over age 50 (other than those ages 60-63) by the end of the year receive an additional catch-up contribution as well. This amount increased by $500 since last year from $7,500 to $8,000. Therefore, their maximum contribution is $32,500 for 2026.

However, there is an additional catch-up for participating individuals ages 60-63 which started in 2025 and will continue into 2026. Thanks to SECURE Act 2.0, this catch-up gets increased from $8,000 to $11,250. This bumps up the maximum contribution amount for individuals ages 60-63 to $35,750.

IRA Contribution Limits for 2026

Other common retirement savings vehicles are the IRA and Roth IRA. Unlike a 401(k), these contributions have to be made manually and do not come from payroll deductions. This requires a little more effort by the saver, but if you're eligible to contribute, doing so can be more than worth your while.

For 2026, the standard contribution increased by $500, to $7,500. As is the case with 401(k)s, those over age 50 by the end of the year are also allowed an additional catch-up contribution which also increased slightly by $100 to $1,100 for 2026 (for an $8,600 total contribution).

Another important aspect of IRA accounts, and especially Roth IRAs, is that your adjusted gross income (AGI) determines whether you are able to utilize the tax benefits in the first place. Unlike the contribution limits, the AGI thresholds to make a Roth contribution did increase slightly for next year. In 2026, you are able to make a full Roth contribution if your AGI is below $242,000 if married and $153,000 if filing single. This is up from $236,000 if married and $150,000 if single in 2025.

If your AGI is above $242,000 but below $252,000 if married, you are allowed to make a partial (prorated) Roth contribution. For single filers, a partial contribution is allowed if your AGI is above $153,000 but below $168,000. If your AGI is above those amounts, you are not allowed to make a Roth contribution in 2026.

SEP IRA and SIMPLE IRA Limits

The administration costs of a 401(k) can be prohibitively burdensome for many small businesses. However, the need for these business owners and their employees to save for retirement is no less important. A couple of fantastic lower-cost alternatives are the SEP IRA and SIMPLE IRA. The specifics of these plans and which one may be right for your business are described in the linked article above. If you already have or are considering starting one of these retirement plans, the limits have gone up in the 2026 rules.

Maximum SEP IRA contributions will increase by $2,000 — from $70,000 to $72,000. While this increase is nice, it is challenging for many small businesses to meet the maximum because of the way the contribution calculation works. This calculation limits a contribution to 20% of net income from the business — meaning that a business would need to earn $360,000 or more of net income to capitalize on the increased limit. But for those that are able to make the maximum contribution, the increase is a welcome benefit.

SIMPLE IRAs also received a small increase, from $16,500 to $17,000 for 2026. Like other retirement accounts, a SIMPLE IRA also allows for a catch-up contribution for those over the age of 50. This limit did increase slightly from 2025 to 2026. The catch-up increased to $4,000 ($3,500 in 2025), for a total maximum potential contribution of $21,000.

What Are the New 2026 HSA Contribution Limits?

One of our absolute favorite retirement savings accounts is none other than the Health Savings Account (HSA). Most retirement accounts offer only two tax benefits: tax deferral and either a tax deduction for contributions going in (but taxed on the way out) or tax-free growth (but no deduction on contributions). However, the HSA allows for a tax deduction on the contributions, tax-deferred growth while in the account and tax-free withdrawals if the money is used for qualified medical expenses, providing the ever-elusive triple tax benefit!

We can gush for hours about the wonders of the HSA. That's why we get so excited when HSA contribution limits increase. In 2026, HSA contributions will increase by $100 for self-only plans and by $200 for family plans. This means the total contributions next year will be $4,400 for self-plans and $8,750 for family plans.

We also note that catch-up contributions remain the same: $1,000. A big difference with these catch-up contributions from other retirement plans is that you must be aged 55 or older, not age 50, to participate.

Summary

As many pension plans have faded away and it has become clear that most individuals cannot survive on Social Security alone, taking control of your own retirement savings has become paramount. Every year, the IRS evaluates contribution limits to these plans and reviews making adjustments. Next year is no different, and many different types of retirement accounts will increase their limits for 2026.

Since these accounts come with tax benefits, it often makes sense to contribute as much as you can to take advantage of them to their fullest extent. If you're already maxing out a plan and its contribution limits are increasing next year, you should consider adjusting your contributions beginning in January. For assistance reviewing your retirement plan and determining whether you're on track, please reach out to our team.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.