As we navigate the complexities of planning for retirement in the modern financial landscape, understanding the nuances between different 401(k) and IRA plans is vital. The choices made today can significantly impact financial security and tax liability in retirement. In the last quarter of 2023, a noteworthy 48% of people proactively chose to increase their 401(k) contributions in employer plans. Amid shifting regulations, choosing the best strategy for your contributions can be difficult. Let's unpack the world of Roth 401(k) and IRA plans to simplify your choices. Not in a traditional plan? Read our recent article A Comprehensive Guide to Retirement Plans for Small Businesses.

The Evolution of the Roth 401(k)

The Roth 401(k) was introduced in 2006 and has attributes of a 401(k) with the tax-free growth and withdrawal benefits of a Roth IRA. Unlike the Roth IRA, the Roth 401(k) has no income limits, making it accessible to higher earners. Initially, few employers offered Roth 401(k) options, but their availability has grown significantly. In 2023, more than 90% of employers providing 401(k) plans included a Roth option. This expansion has allowed employees more flexibility in tax planning and retirement savings, accommodating a broader range of financial strategies and personal circumstances. Conversely, only 51% of 403(b) plans offered a Roth option.

Roth 401(k) vs. Traditional 401(k)

The combination of the tax-free growth and tax-free withdrawals of a Roth 401(k) provides a clear benefit for individuals who anticipate higher tax rates in the future. Despite not offering an immediate tax deduction, the Roth 401(k) has become increasingly popular for its potential tax savings in retirement, especially with recent legislative changes delaying certain requirements for high earners until 2026.

A traditional 401(k) plan allows employees to save for retirement by contributing a portion of their pretax income, thereby reducing their taxable income for the year. These contributions grow tax-deferred until withdrawal in retirement when they are taxed as ordinary income. The immediate tax deduction makes this plan a cornerstone of retirement planning, especially for those who expect to be in a lower tax bracket in retirement.

Roth 401(k) and traditional 401(k) plans have an aggregate contribution limit for employee deferrals of $23,000 in 2024. If you're over 50, there is an increased limit of $30,500.

If you expect your income tax rate to be higher in retirement than it is now, then it makes more sense to contribute to a Roth than to a traditional account. Important caveat: Many people expect to be in a lower tax bracket in retirement but don't factor in that their retirement and investment income plus Social Security and higher future tax rates can mean they are in a higher tax bracket in retirement! In many cases, especially for young people just beginning their careers, it makes sense to contribute to Roth IRAs and Roth 401(k)s instead of traditional IRA/401(k) accounts.

What are the implications of rolling over your Roth 401(k) account balance into your Roth IRA?

Roth 401(k) rollovers are treated like a traditional 401(k) rollover. The Roth portion of your employer plan can be consolidated into your Roth IRA, without tax penalty. This does not affect your contribution limit for your Roth IRA that year.

Roth IRA and Traditional IRA

The Roth IRA stands out for its tax-free growth and withdrawal benefits, but it has an income eligibility limit. It's an attractive option for those planning for a higher tax rate in retirement or seeking flexibility, as contributions (but not earnings) can be withdrawn without penalty before retirement.

A traditional IRA remains a versatile tool in retirement planning, offering tax-deductible contributions and tax-deferred growth, with taxes only applied upon withdrawal. It's especially beneficial for individuals without employer-sponsored plans or those below the income thresholds for deductibility, providing a pathway to lower current taxable income while saving for retirement.

Both traditional and Roth IRAs have much smaller contribution limits than 401(k)s. In 2024, if you're eligible, you can contribute up to $7,000, or $8,000 if you're 50 and older. In order to contribute to either, you must have earned income. Earned income is from some kind of work, either W2 income or self-employment income. Either spouse's income can count for both spouses to contribute. This way, a nonworking spouse can still contribute.

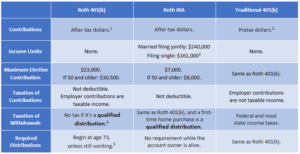

The table below provides a simplified breakdown of the distinguishing traits between these retirement accounts. It's important to note that there are exceptions to the generalized rules listed.

Choosing the Right Plan: Strategic Considerations

The choice of retirement savings plan should be informed by your current financial situation, projected income in retirement, and specific goals. With each plan offering distinct advantages, individuals must consider their current tax bracket, expected future income, and the potential need for early access to funds.

The evolution of Roth 401(k)s reflects a broader shift toward diversification and flexibility in retirement planning, acknowledging the varied financial landscapes individuals face. Diversifying savings into different accounts, like HSAs, can provide increased value and flexibility due to their varying tax consequences and regulations.

It’s critical to understand the rules, limitations, and tax implications of each type of retirement account. Traditional 401(k) and IRA contributions can reduce current taxable income, potentially offering immediate tax relief, while Roth accounts focus on tax-free growth for future benefit. The optimal strategy for contributing to these different accounts is dependent on an individual’s financial situation and goals. Determining the optimal plan can be complex and overwhelming, and we are here to help.

Conclusion: Tailoring Retirement Strategies for Future Success

As we move through 2024, the landscape of retirement savings is marked by a wealth of options, each with its unique considerations. From the tax-deferred savings of traditional 401(k)s and IRAs to the tax-free growth of Roth accounts, understanding the differences is key to tailoring a retirement strategy that aligns with individual tax situations and goals.

As the retirement planning landscape continues to evolve, staying informed and adaptable is crucial. By carefully considering each option’s tax implications, benefits, and limitations, individuals can build a retirement savings strategy that not only meets their current financial needs but also secures their financial future. Whether prioritizing tax-efficient growth with Roth options or leveraging the immediate benefits of traditional accounts, the path to retirement success is built on a foundation of strategic planning and informed decision-making. Your circumstances are unique to you. If you need assistance with your overall financial plan, we encourage you to reach out to our team.

[1] Roth 401(k) plan contributions must be designated Roth employee elective contributions.

[2] Traditional 401(k) plans must be employee elective contributions.

[3] The Roth IRA income limits are the absolute maximum income to be eligible to contribute to this IRA. For married filing jointly, the amount you are allowed to contribute to a Roth 401(k) decreases as your modified adjusted gross income surpasses $230,000, until no contribution is allowed at $240,000. For filing single, this phase-out range begins at $146,000.

[4] To be a qualified distribution: the account is held for at least five years and made on account of disability, on or after death, or on or after attainment of age 59.5

[5] You must take a required minimum distribution if you are a > 5% owner of a business.