Stock and bond markets are falling, inflation is persistent, and the media keeps talking about a recession…what portfolio changes should you make?

Should I Sell My Stocks?

The current volatility in the stock market has many people asking the same question. The answer is no, you should not sell your stocks. Let’s remember that the average intra-year decline (drop at some point during one calendar year) is about 14%. 1 We simply forget about this after the markets have recovered again.

When your portfolio falls steeply, it is normal to have an emotional response. Do not react to it! By far the most powerful emotion in investing is long-term regret, and if you sell now, you will certainly regret it later.

Successful, long-term investing does not rely on emotions. The stock market is made up of real companies, and real companies produce earnings. If the economic outlook is so bad, why aren’t earnings estimates dropping? S&P 500 earnings were $209 for 2021 and are estimated to be $215 for 2022 and $235 for 2023 . Could there be too much bearishness around?

I am not saying that the equity market has bottomed out or that it soon will. To make that statement, I would have to know the unknowable: the future direction of inflation, interest rates, and corporate earnings, and how the stock market will react to all of them. Despite many people opining on this subject, no one truly knows. The only way to be reasonably sure of capturing and compounding the permanent return of stocks is to ride out their sometimes significant but always (historically) temporary declines. To quote Peter Lynch, “The real key to making money in stocks is not to get scared out of them.” Don’t sell your stocks. Further, do not hold back cash that needs to be invested, trying to catch a market bottom. They don’t ring a bell at the bottom!

Inflation and Recession

Many people underestimate their life expectancy and the amount of money they will need to pay for basic living expenses in those later years of life. Inflation is the rising cost of living that has become much more noticeable to everyone in the past year. The cure for inflation is higher interest rates and a recession. “Recession” is a scary buzzword that does not mean anything to your day-to-day life. If an economic slowdown over a few calendar quarters is what it takes to stamp out inflation, it would be by far the lesser of two evils. Inflation is a cancer, and it must be destroyed.

If consumers stop spending, inflation will break. Once inflation breaks, interest rates will fall, and when that happens, stocks and bonds may soar very quickly. If you are out of the market, you will miss the rise. The risk is not by being in the next 20% decline in the market; it is by being out of the next 100% advance.

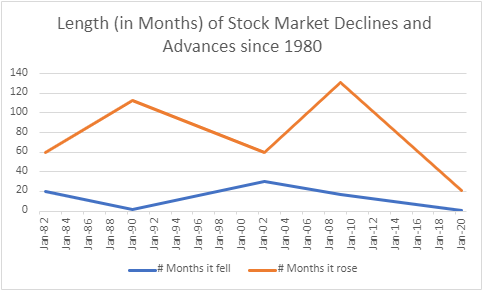

Sometimes a picture is worth a thousand words:

It is interesting to note that in the past 50 years through 2021, the consumer price index has risen 639% 2 while the S&P 500 dividend has risen 1,873%. 3 Another notch in the belt for owning stocks.

Should I Increase My Bond Exposure?

The short answer is no. Many people own bonds as protection against a sudden stock market decline. However, when interest rates rise, bond prices fall, as a buyer can buy a new bond at the higher interest rate, so a seller must discount the price of their bond until the yield the investor will earn is equal to the current interest rate. Therefore, bonds do not protect you against stock market declines that were the result of rising interest rates.

Another reason people own bonds is for steady income. Here is an exercise: 20 years ago, if you purchased a $1,000, 20-year Treasury bond, it was paying about $58 in interest, about a 5.8% interest rate . The S&P 500 was trading at $880, and dividends on the S&P 500 were $15.96, or 1.81% (or $18 on your $1,000 investment). The bond looked like a much better deal! Fast-forward 20 years. The S&P 500 is trading at (a depressed value of) $3,585 (as of 9/30/2022), an increase of over four times, over 20 years. The annual dividends are now $59.20 per year (as of 2021).

Summary:

The 20-year bond: You collected your $58 in interest every year ($1,160 over the 20 years), and your bond matured, so you also received your $1,000 back. Total value after 20 years: $2,160.

The S&P 500: Your $1,000 is now worth over $4,000, including reinvested dividends.

Taxes: You paid “ordinary” federal income tax rates on the US Treasury bond interest (but no state income taxes). You likely paid lower “capital gains” federal tax rates (likely 15%) on your dividends over the years (with state income taxes).

Which was the better option? The S&P 500 option doubled the results of the 20-year bond, with income taxed at preferential income tax rates.

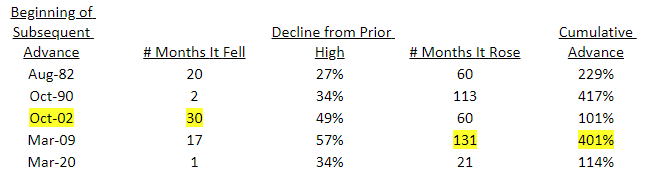

The only real reason to own bonds is to reduce your exposure to equity volatility. Let’s discuss that for a minute. The duration of equity volatility since 1982 is captured in the above chart. The breadth is tricky to quantify, if only because the price cannot decline more than 100%, but its upside potential is unlimited. Here are the numbers behind the above chart:

The longest stock market decline since 1982 was less than three years. The longest stock market advance since 1982 was over 10 years! It is worth repeating: The risk does not lie in being in the next 20% decline in the market; it lies in being out of the next 100% advance.

Another important statistic, thanks to the DFA graphic “The Bumpy Road to the Market’s Long-Term Average,” is that while the S&P 500 has averaged 10% annual returns, in only seven out of the last 96 years has the return been between 8 % and 12%! Market returns are extremely variable, and we should expect that.

But I’m 80 Years Old, and My Time Horizon Is Short!

Any logical investor will want their money to last as long as they do. Since none of us knows how long we have, there is no way to make sure you have sufficient capital than to save enough to withstand any market condition (inflation, interest rates, recession, etc.). When you do this, you will have accumulated substantial capital. Your time horizon should be based on how much capital you have invested and how much money you need to spend every year.

When you have saved appropriately and accumulated enough capital, you realize you only need a small percentage of it each year for expenses. This is when you realize that the short-term swings of the market have no impact on your paying your current living expenses. In this situation, your time horizon for retirement assets is almost always greater than 20 years.

Your time horizon is not your life expectancy, as you cannot take your money with you when you die. If you are spending so much that you may spend all your money before you die, you have woefully under-saved.

But the S&P 500 Is Down 24% Year to Date!

Yes, the S&P 500 is down significantly year to date. Remember, three times since 1970 the S&P 500 has declined by about half. However, the S&P 500 is made up of the stocks of actual companies. The list of companies in the S&P 500 today includes names such as 3M, Apple, ADP, Alphabet (Google), Amazon, American Express, Chipotle, Coca-Cola, Disney, eBay, General Mills, General Electric, Hershey, Intel, Johnson & Johnson, McDonald’s, Meta (Facebook), Microsoft, Pfizer, Procter & Gamble, Tesla, Tyson, UPS…you get the idea. Do you really believe these companies, just since January 1, have permanently lost a quarter of their value?

Many people have come to me over the years looking for help with financial planning and investment management. In my experience, the best way to destroy your chance for lifetime investment success has historically been to sell your stock portfolio into a bear market. To sell when investor sentiment is so negative that most S&P 500 stocks are trading lower almost every day is to sell when everyone else is selling, never a good idea. Many people wildly overestimate the negative effect of short- to intermediate-term equity market declines on their long-term capital accumulation.

The question is not what bad things are going to happen this year but how much of what is going to happen is not already in the price.

What If I’m Sitting on Cash?

This is the time to deploy cash for any serious long-term goal. If you are still nervous about doing so, split it over six to 12 months and automate the investment.

What Do I Do with My Portfolio?

You follow your written investment policy statement. You continue to own a diversified portfolio of companies of the world. You do not make investment policy out of current events, no matter how distressing. You focus on what you can control: Is your estate planning up to date? Will your money pass the way you want it to after you pass on? Have you planned for long-term-care costs for yourselves so you aren’t a burden on your children? Have you looked at your lifetime taxes and how you can save income taxes or state estate taxes?

Lastly, take a deep breath. All this unwelcome news and chaos has been exhausting for all of us, but this, too, shall pass. Save as much as you can, spend as little as necessary, own stocks, collect dividends, and live your life.

1 Guide to the Markets | J.P. Morgan Asset Management (jpmorgan.com) , 9/30/2022, page 15. This number has been static for some time.

2 Consumer Price Index Data from 1913 to 2022 | US Inflation Calculator , 1971 CPI: 40.5; 2021 CPI: 258.811.

3 https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/spearn.htm , 1971 dividend: $3.16; 2021 dividend: $59.20.

This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor.Jennifer Climo, CFP®, CPA, MSFP is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .