Author: Jonathan Harrington

It is common for individuals to make excess contributions to health savings accounts, Roth IRAs, 401(k)s, 403(b)s and 457(b)s. So common, in fact, that the IRS has a lenient policy for removing these excess contributions to avoid most penalties. So, if you discover that you’ve made an excess contribution to any of these account types, don’t worry, because there is a way to fix it.

Note: For purposes of this article the tax filing deadlines are noted as April 15th and October 15th even though the exact days in these two months may vary from year to year.

Circumstances Where Excess Contributions Occur

Individuals typically figure out that they have made excess contributions during tax time when all of their various tax forms are reconciled by a tax preparer, a CPA or tax software. Contributions are recorded on W-2s and 5498s, and during tax preparation, the amounts from those forms are entered into the tax software. Once all the data is entered, it may show that an excess contribution has been made. Some of the most common reasons for excess contributions include:

- You simply miscalculated the amount you were allowed to contribute.

- You changed jobs, and your combined withholding from your multiple jobs exceeded the annual limits.

- Your modified adjusted gross income unexpectedly exceeded the limits that allow contributions to a Roth IRA.

- You maintain multiple IRAs, contributed to both and inadvertently contributed too much.

- You participate in more than one 401(k), 403(b) or 457(b), and your combined contributions exceeded the allowable limits.

- Your income during the year was less than the total amount of your IRA contributions.

- Your employer made contributions to your health savings account, which you forgot to account for when making your own contributions.

- You made a large health savings account contribution early in the year and then lost your eligibility later in the year.

- You made a health savings account contribution during a year when you weren’t participating in a high-deductible health plan.

Contribution Limit Basics

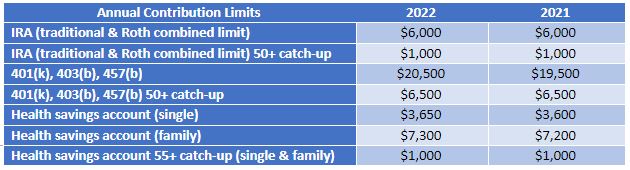

The contribution limits for tax-advantaged retirement plans and health savings accounts can be confusing because the amounts are different for each plan type and can change from year to year. The chart below shows contribution limits for each account type in 2021 and 2022.

Note: All contributions to retirement plans are dependent on earned income. You can only contribute up to the amount you have earned in income during the year. Income earned by a spouse can be attributed to the other spouse for this calculation.

Special catch-up provisions apply for IRAs, 401(k)s, 403(b)s and 457(b)s, where those aged 50 or older can contribute an extra $1,000 to a traditional or Roth IRA, or an extra $6,500 to a 401(k), 403(b) and 457(b). Health savings account catch-up contributions start at age 55, and an extra $1,000 can be contributed for either a single or family health plan.

Example. Will is turning 50 in December 2022 and wants to maximize his contributions to his 401(k). Because he will be 50 by the end of the tax year (December 31, 2022), he can contribute $20,500 plus the $6,500 catch-up for a total of $27,000. His wife, Sarah, who is 47, also wants to maximize contributions to a retirement plan but does not have an employer-sponsored retirement plan like a 401(k). She can make a contribution to her IRA and can contribute the maximum of $6,000.

Coordinating 401(k) and 403(b) Plan Deductions and what about 457(b) plans?

The limits that apply to 401(k)s and 403(b)s are collective across plan types. That means if you can contribute to multiple types of these plans, your collective contributions cannot exceed the 2022 limit of $20,500 plus the catch-up if it applies. Employees who can access 457(b) plans can contribute an additional $20,500 – but these rules are beyond the scope of this blog, other than to note that government employees who have access to both a 403(b) and a 457(b) can possibly double their contributions by contributing to both a 403(b) and a 457(b) plan .

Special Traditional IRA Limitations

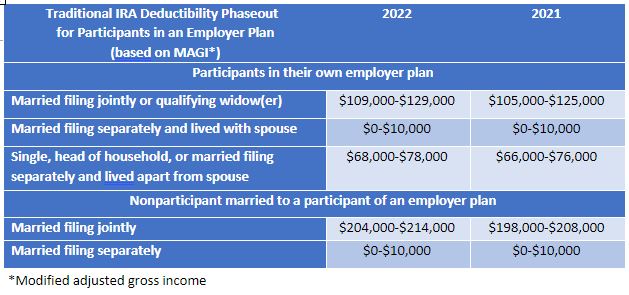

In order to further confuse people who want to maximize contributions to retirement accounts, there is a special rule that limits tax-deductible contributions to IRAs for participants in an employer-sponsored retirement plan, like a 401(k), 403(b) or 457(b). If your modified adjusted gross income exceeds the amounts listed in the table below, you are not able to make tax-deductible contributions. You can still contribute to a traditional IRA but cannot deduct the contribution. Note: The tax ramifications for how a nondeductible contribution works within a traditional IRA are beyond the scope of this article.

Example. Continuing the example of Sarah and Will above, they file as married filing jointly and have a modified adjusted gross income of $140,000. Sarah is not covered by an employer retirement plan, and because their income is below $204,000, she can make the full $6,000 deductible contribution to a traditional IRA. Will, who is covered by an employer retirement plan, is not able to make a deductible traditional IRA contribution because their income exceeds the $129,000 deductibility threshold.

If Sarah and Will’s modified adjusted gross income were $119,000, they would be halfway through the phaseout that applies to Will. Therefore, he could contribute 50% of the $6,000 limit, which equals $3,000.

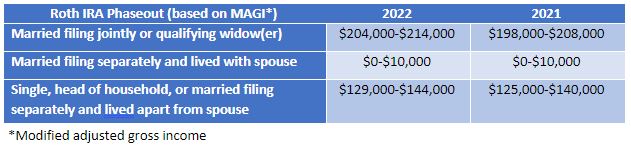

Special Roth IRA Limits

The ability to contribute all or part of the $6,000 annual maximum to a Roth IRA is dependent on the modified adjusted gross income of the individual and that person’s tax filing status. If your income exceeds the threshold for the phaseout ranges listed in the table below, which are based on filing status, you cannot make Roth IRA contributions. Note that your or your spouse’s participation in an employer-sponsored retirement plan is not relevant to this calculation.

Examples.

Barbara is single, age 40, and had a modified adjusted gross income of $170,000 in 2021. Because her modified adjusted gross income exceeds the threshold for contributing to a Roth IRA, she is not able to make any Roth IRA contributions.

Ken, age 60, is married, and his and his spouse’s modified adjusted gross income will be $209,000 in 2022. They file married filing jointly, and their modified adjusted gross income is in the middle of the phaseout range of $204,000-$214,000, so Ken can contribute 50% of his maximum contribution amount. In 2022, this means 50% of the standard contribution of $6,000 plus 50% of the $1,000 catch-up, for a total of $3,500.

Fixing an Excess Contribution

Fixing an excess contribution is different for IRAs, 401(k)s and health savings accounts, so we’ll cover each separately.

Traditional and Roth IRAs

In general, if the excess contributions for a year aren’t withdrawn by the date your return for the year is due (including extensions), you are subject to a 6% excise tax on the amount of the excess contribution, not including earnings. (See discussion below.) You must continue to pay the 6% excise tax for each year that you do not withdraw the excess amount, so it is important that you remove it as soon as you become aware of it.

There are a couple of deadlines for making the withdrawal of the excess contribution in order to ensure that it does not become subject to a penalty.

If you catch the excess contribution when preparing your tax return , you can make the withdrawal by your tax filing deadline of April 15, or by October 15 if you have an extension. Then you simply will not take a deduction for more than the annual limit.

Example. Denzel made a $7,000 contribution to his IRA because he was confused by the catch-up provisions. While he was completing his tax return, he realized the error, called his account custodian and determined that he needed to withdraw the $1,000 excess contribution along with $10 in earnings. Denzel will simply take a $6,000 deduction for his contribution to his IRA and ignore the $1,000 excess contribution because he withdrew it by his tax filing deadline. He will include the $10 in earnings that he withdrew on IRS Form 5329, and that amount will be subject to a 10% penalty. (See Withdrawing Earnings below.)

If you catch the excess contribution after you have submitted your tax return , you have six months from the due date of your tax return, excluding extensions. For most people, this means you must act by October 15. You then must file an amended tax return reflecting the reduced contribution amount and include any earnings associated with the excess contribution, which would be subject to the 10% penalty.

Example. Jason contributed $12,000 to his IRAs in 2021 because he had two IRAs and inadvertently contributed $6,000 to each of them. He filed his tax return by April 15 and only claimed one of the $6,000 contributions, because one of the 5498s arrived late. Once he realized his error, he took a full withdrawal from the IRA that he made the second $6,000 contribution to, because it was the only contribution that he had ever made to that IRA. The account had grown to $6,400 by the time he took the full withdrawal. Jason will have to file an amended return, but because he only included $6,000 on the original return (and not the full $12,000 he had contributed), he will only update the amended return to include the $400 in earnings that were part of the $6,400 withdrawal on IRS Form 5329 and be subject to a 10% penalty on that amount.

There are also several opportunities to fix the excess contribution while leaving the excess contribution in the IRA .

Apply it to the next year. You can apply the excess contribution to count toward your contribution for the current taxable year (but not for a previous year) if you have not already made the maximum contribution for the current year. This application to the next tax year also needs to be completed by the tax filing deadline. You must withdraw the earnings (if any) attributed to the excess contribution even if you apply the previous year’s excess contribution to the current year’s contribution limit.

Recharacterize it. Moving a contribution from a traditional IRA to a Roth IRA is referred to as “recharacterizing” the contribution. You have the option of doing this if your modified adjusted gross income phases you out of making deductible traditional IRA contributions but you are under the threshold for making Roth contributions. You can recharacterize IRA contributions up until the due date of your tax return, including extensions.

401(k)s, 403(b)s and 457(b)s

The way that excess deferrals (the phrase for excess contributions to 401(k)s) are handled for 401(k)s, 403(b)s and 457(b)s is much simpler than the way excess contributions to IRAs are handled.

If you discover that you have made an excess deferral to a 401(k), 403(b) or 457(b), you can call the plan administrator and ask for a corrective distribution. A corrective distribution will not be subject to the 10% tax for early distributions. The corrective distribution must be made by April 15 and cannot be postponed by tax filing extensions.

Corrective distributions will generate a 1099-R, which will be reported as an addition to wages for the tax year that you made the excess deferral. Alternatively, your employer can issue a corrected W-2 to reflect the updated deferral amount and a 1099-R that reflects the portion of the corrective distribution that is related to earnings. The earnings associated with the excess deferral are reported in the year that you take the corrective distribution.

Example. Erin is 40 years old, and for 2021 she deferred $20,000 to her employer’s 401(k) plan (which is the only plan in which she participated for 2021). None of the deferrals were designated Roth elective deferrals. Erin has excess deferrals of $500 because $19,500 is the 2021 annual limit for individuals under age 50. The allocable earnings on the excess elective deferrals through December 31, 2021, were $25. If the excess elective deferrals (and allocable earnings) were distributed from the 401(k) plan to Erin on or before December 31, 2021, Erin must include $525 in gross income for 2021. If the $525 was distributed from the 401(k) plan to Erin between January 1, 2022, and April 15, 2022, Erin must include $500 in gross income for 2021 and $25 in gross income for 2022.

Late corrective distributions can be subject to double taxation because the excess amount is taxable to you in the year that you made the contribution and in the year that you receive it as a distribution. If you don’t ask for the corrective distribution to be made to you by April 15, then the amount will sit in the plan until you withdraw it in the future, at which point it will be subject to income tax again .

Health Savings Accounts

The rules for excess contributions to health savings accounts are a hybrid of the rules for IRAs and the rules for 401(k)s.

I f you discover that you have made an excess contribution to a health savings account , you can avoid paying the 6% excise tax by withdrawing some or all of the excess contributions and associated earnings by your tax return due date, including extensions, for the tax year after the excess contributions were made.

The distributions of excess contributions are reported on IRS Form 1099-SA in box 1. The earnings associated with the excess contributions that are withdrawn are reported in box 2. Your employer may also adjust your wages in box 1 of your W-2 so that the excess contribution isn’t included in box 1 of Form W-2. In this case, you would only report the 1099-SA box 2 earnings as “Other income” on your tax return. The earnings associated with the excess contribution are reported in the year that you take the corrective distribution.

The distribution of earnings from the health savings account to correct an excess contribution is not subject to a 10% penalty. (See Withdrawing Earnings below.)

If you fail to take a distribution of the excess contribution by your tax filing deadline, it will be subject to the 6% excise tax for every year that it remains in the account.

Withdrawing Earnings

One important part of determining the amount that you need to withdraw is determining the associated earnings (if any) that are attributed to the excess contribution, because these must also be removed.

This calculation can be somewhat complicated because of the timing of the contribution and how funds were invested during the year. Your custodian may be able to make the calculation for you. You can take into account any loss on the contribution while it was in the IRA when calculating the amount that must be withdrawn. If there was a loss, you may end up withdrawing less than the original contribution amount.

For calculation purposes, the latest contributions that you made during the year will be considered the excess contributions. That helps with minimizing the amount of earnings that you need to withdraw.

You must correct the excess from the same account that you made the contribution to. If you have multiple accounts of the same type as the account you made the excess contribution to (which may have led to the excess contribution in the first place), you need to take the excess from the account that you contributed to last during the year, which created the excess contribution.

IRAs only: The withdrawal of earnings is subject to a 10% early withdrawal penalty if you are under 59½ when the withdrawal is made. See I RS Publication 590-A and IRS Publication 590-B for possible exceptions to the 10% penalty.

Failure to Remove an Excess Contribution

It is possible that you will miss an excess contribution that you made in a prior year and inadvertently leave the contribution in your account. The rules for correcting this circumstance are complicated, and it is best that you talk to a tax professional to help you correct it so you can avoid penalties for the excess contribution and associated earnings every year that the amount is left in the account.

Resources:

2021 Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs)

2021 Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs)

2021 Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans

Conclusion

Mistakes sometimes happen, but a relationship with a good financial advisor/tax preparer can help fix them before the consequences worsen. If you want to review your overall financial situation with a professional, please reach out to our team .

Jonathan Harrington, CFP®, MSFP, MST is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .