Arguably, one of the greatest financial lessons a parent can teach their child is how to delay gratification today for a more important goal in the future. This may be something that goes against evolution itself. That is why it is even more critical to instill this habit as early as possible. One way of doing so is encouraging your child to save in a Roth IRA. By starting your child on the path to saving at an early age, it may be possible to create the foundation to a successful retirement and overall financial wellbeing. The key to doing so lies with three key concepts: the Roth IRA, compound interest, and consistent contributions over time.

What is a Roth IRA?

The Roth IRA is an account that the IRS (Internal Revenue Service) created to help people save for retirement. The concept behind a Roth is similar to other retirement accounts, such as your workplace 401(k), with one big difference. With a Roth IRA you have already paid taxes on the money you put into the account, and it will grow tax-free. (Note: You can withdraw the amounts you contributed tax-free before age 59.5). To determine whether you should contribute to a Roth IRA, Roth 401(k) or to your regular, pre-tax 401(k) (or both!) it is helpful to think about what your tax situation is currently and what it is likely to be in the future. If you are in a low tax bracket now, and expect to pay more in taxes later, you are usually better off investing in a Roth account. For many, that means when you are younger it is advantageous to use a Roth and then transition to a regular 401k as your income (and tax bracket) rise. This is even more beneficial for the very young.

Retirement accounts often have penalties associated with withdrawals before age 59.5. For a Roth IRA, a 10% penalty may be applicable on any earnings withdrawn before 59.5 unless an exception applies . The incredible income tax-free growth and compounding of a Roth IRA should discourage individuals from making early withdrawals, but as mentioned above, your contributions can be withdrawn income tax-free and penalty-free at almost any time.

You must have “earned income” to contribute to a Roth IRA. Examples of earned income are wages from a job, self-employment income or taxable alimony. (Note that unemployment income is not considered earned income). Your child can contribute 100% of their earned income up to $6,000 total for 2021.

To help illustrate this, let’s say your 13-year-old son, Johnny, earned $3,200 shoveling snow and mowing lawns this year. In this case, he can make a Roth contribution of up to $3,200. If, however, Johnny made $7,000, then he could only contribute $6,000. By encouraging, and even helping Jonny make this contribution, you can start him on the path to saving and building habits that hopefully stick with him for a lifetime.

What Qualifies as Earned Income For Your Kids?

The IRS has stated that earned income cannot be for personal chores such as brushing your teeth or making your bed. The income must be related to a trade or business. This can include services performed by your child for others like babysitting, house cleaning, lawn mowing, shoveling driveways, technology services, tutoring; or working in a parent-owned business. The wage must be appropriate for the task at hand, meaning you cannot pay your child $500/hour to shovel the driveway when the going rate is only $10/hour. If you have doubts regarding whether or not the task is considered earned income, you should talk with your accountant or financial advisor prior to contributing to a minor’s Roth IRA. The minor also has to file a tax return in order to contribute.

Keep in mind that the tax filing status for your child can be complicated, and often the best filing approach depends on their state of residency and their parents’ tax situation. That is why it is important to discuss your specific details with your CPA or Certified Financial Planner™ professional.

Once your child does have earned income, compound interest comes into play.

How Does Compound Interest Work?

Compound interest is a marvel that allows a few dollars today to turn into many dollars tomorrow. To understand how compound interest works it is important to understand how simple interest works. With simple interest your money earns a set amount each year.

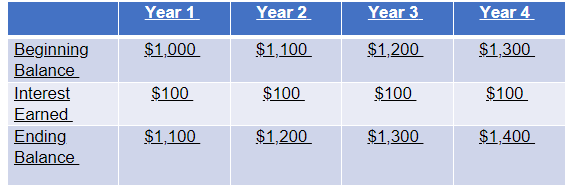

For example, if you invested $1,000 and earned 10% in simple interest each year for four years, then your results would be:

After four years, your investment would have grown to $1,400. Not too bad, right?

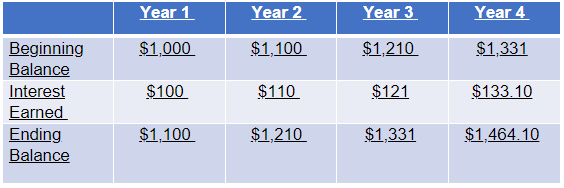

Now let’s look at the same example, but this time our money will grow using compound interest. With compound interest, not only do we earn money on our original investment, we also earn money on our prior earned interest. If we keep everything the same as the above example and just switch from simple to compound interest, we get the following results:

With compound interest, you would earn an additional $64.10. Now this may not seem like much but when you layer compound interest onto yearly deposits and sprinkle in a little time and patience, the results can become quite sizable.

The Power of Consistency and Time

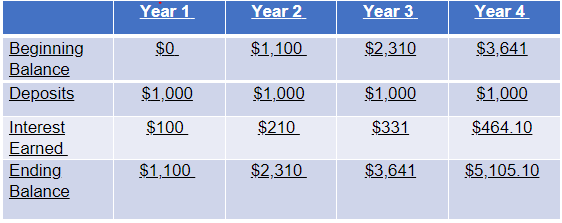

Without consistency and time, compound interest has a far smaller impact. As the example above shows, the total balance in our account only increased from $1,000 in year 1 to $1,464.10 in year 4. That is only an increase of $464.10. However, if we layer in consistent, recurring deposits, then that number really starts to grow.

By adding yearly deposits of $1,000, in year 4 you now have $5,105.10 instead of just $1,464.10. That is a difference of $3,641. By consistently investing $1,000, your $4,000 investment grew to $5,105. This goes to show that the sooner one starts to invest consistently and the longer they stick with it, the better their situation becomes.

Putting it all Together

Let’s see the wonders possible from the combination of a Roth IRA, compound interest, and consistent savings over time.

Your 8-year-old son Mike has been mowing lawns and shoveling driveways for people around the neighborhood. He spends about 5 hours a week earning $10/hour for his time, taking home a total of $50/week. He works 48 weeks a year and so earns $2,400 of earned income by the end of the year. With this, Mike can contribute up to $2,400 to his Roth IRA.

“Hold on!” you might be saying. “What 8-year-old wants to put all their hard-earned money into an account for something 50+ years in the future?” Well, that is a great point, and this is where you can really help encourage your child to save and teach the habits of patience and consistency. You can help fund their Roth IRA, up to the $2,400 maximum contribution limit.

Even though the IRS says that an individual needs to have earned income to contribute to a Roth IRA, they do NOT stipulate that the money put into the Roth is the same money that was earned. With this in mind, it is possible for others to contribute money towards someone else’s Roth IRA.

You can help encourage Mike’s saving for the future by matching the money Mike puts into the Roth IRA. By telling him that you will put $1 into his Roth for every $1 he puts in himself, you can help entice Mike to save while allowing him the ability to enjoy the fruits of his labor. Showing Mike this blog, you can help explain to him that, through saving and investing, he will end up with much more than $2,400.

Let’s say that Mike decides to take you up on your offer, and between you and Mike, $2,400/year is invested in his Roth IRA. This habit alone would be enough to set Mike on a great path to success. That means that if $2,400 in total contributions were made to his Roth IRA each year through the age of 18, Mike would have $26,400 worth of contributions in his Roth IRA. Now if that money were invested, the results could be even higher. It is important to note that investing has risks, and past performance does not predict future returns. However, if we assume that Mike received an average annual return of 7% per year, then that $2,400/year contribution would have grown to $37,881. That is a gain of $11,481.

If Mike never invested another dollar the rest of his life, and he continued to receive an average return of 7% from the age of 18 until he retires at age 65, he would have a Roth IRA balance of $910,867. That means that the investment into his Roth account of only $26,400 increased by nearly $885,000.

What happens if Mike decided not to stop investing at 18 and, instead, kept saving and investing with yearly contributions of $2,400 into his Roth IRA through the age of 65? In this situation, he would end up with an ending balance of $1,701,005. Not a bad nest egg! And the best part is that money can now be taken out tax-free. He would be in a solid financial position come retirement.

The importance of investing early and often is even more striking if we contrast Mike’s situation to Jane’s. Jane was not as fortunate and did not form the same saving and investing habits as Mike.

Unlike Mike, Jane started investing $2,400/year not at the age of 8 but at the age of 30. If she continued investing that amount in her Roth IRA each year until she turned 65, then she would end up with only $357,392. This is a far cry from the over $1.7 million that Mike ended up with.

If we go back to the first scenario outlined with Mike, where he started saving and investing at 8 and stopped after the age of 18, we see he STILL ends up with more money at 65 than Jane does even though Jane would have contributed over three times more money. The reason for that is the power of time and compound interest.

Mike’s contributions: $2,400/year from ages 8 through 18.

$2,400/year for 11 years = $26,400

Jane’s contributions: $2,400/year from ages 30 through 65.

$2,400/year for 36 years = $86,400

That is why it is so important to start the habit of consistent saving and investing as early as possible. In these scenarios, Mike was saving less than $50/week each year (on average) and still ended up with a multi-million-dollar Roth IRA by his retirement. And the key was he built a habit of consistently contributing and investing money to his Roth IRA over time.

(Side note: as long as Mike does not take a distribution from his Roth IRA during college, it doesn’t impact his financial aid awards.)

As the saying goes, the best time to start investing was yesterday and the next best time is today. By teaching your kids the importance of consistently saving even small sums of money and investing that money for the long-term, you can help make a significant impact on their overall financial well-being.

Kyle Labelle is a Planning Associate at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .