As a high-income earner, you’ve worked hard to achieve financial success. But as your income grows, so does the complexity of your taxes and the amount you owe. Watching a significant portion of your earnings go to taxes can be frustrating. The good news? Strategic tax planning can help you find ways to minimize your tax burden.

In this comprehensive guide, we’ll cover practical and proven tax strategies used by many high-income earners, focusing on how to reduce taxable income. Whether you’re a business owner, executive, physician, or other high-earning professional, these strategies offer a well-rounded approach that is designed to lower your taxable income while helping you build lasting wealth.

Key Points:

- Retirement Account Maximization

- Investment Tax Strategies

- Health Savings Accounts (HSAs)

- Strategic Deductions for High-Income Earners

- Real Estate Investment Strategies

- Charitable Giving Strategies

- Estate-Planning Strategies

- Other Tax-Advantaged Investments

- Tax-Efficient Education Funding

- State Tax Planning

Who Is Considered a High-Income Earner?

High-income earners usually fall into the top three tax brackets or have taxable income over $197,300 annually ($394,600 if married and filing jointly). This includes wages, investment income, business profits, and other sources reported on your tax return, less all deductions, such as interest, allowable medical expenses, state taxes, charitable contributions, HSA and IRA contributions, self-employed health insurance and retirement contributions, and any other deductions.

High-income earners often face a range of tax challenges and complexities:

- Higher tax rates: You might pay up to 37% in federal income tax on your earnings, plus state income taxes, depending on where you live.

- Investment taxes: You could pay an extra 3.8% tax on certain investment income like dividends, interest, and capital gains if your income exceeds $200,000 (single) or $250,000 (married).

- Lost tax breaks: Certain deductions and credits start to phase out as your income increases.

- Extra Medicare tax: If you earn more than $200,000 (single) or $250,000 (married and filing jointly), there’s an additional 0.9% Medicare tax on income above that amount.

- Alternative minimum tax (AMT): This is a special tax that might affect you, depending on your situation.

- Capital gains tax: Profits from selling investments may be taxed at higher rates (up to 20%) if you’re a high earner, plus the 3.8% net investment income tax that may apply.

To help manage these challenges, here are 10 effective strategies to reduce your tax liability:

1. Retirement Account Maximization

Maximizing contributions to tax-advantaged retirement accounts remains one of the most effective and immediate tax strategies for high-income earners. Contributing to 401(k)s and IRAs reduces your taxable income for the year, especially valuable during peak earning years when you’re in higher tax brackets.

For 2025, you can contribute:

- Up to $23,500 to a traditional 401(k) or 403(b) plan. If you’re age 50 or older, the limit increases to $31,000, which includes a $7,500 catch-up contribution. For those between ages 60 and 63, the catch-up contribution rises to $11,250 under SECURE 2.0, allowing a total contribution of $34,750.

- Up to $7,000 to a traditional IRA (or $8,000 if 50 or older), though income limits may affect deductibility.

Beyond standard retirement accounts, high earners often benefit from advanced strategies:

- Solo 401(k) or SEP IRA: If you are a self-employed business owner, both plans allow contributions of up to $70,000, with a higher limit of $77,500 for those 50 or older. A solo 401(k) lets you contribute both as an employee and as an employer, plus it offers a Roth option for tax-free withdrawals in retirement. A SEP IRA, on the other hand, is simpler to manage, but contributions come only from the employer—up to 25% of compensation, with a $350,000 cap on compensation used for the calculation. Both plans offer valuable tax benefits and help you build long-term savings, but the best choice depends on how much flexibility and control you want over your contributions.

- Cash Balance Plans: Cash balance plans are a type of defined benefit pension plan that allows business owners and high-income professionals to make substantial annual contributions, significantly higher than those permitted in traditional retirement accounts. For example, a business owner in their 60s with a high income could contribute well over $200,000 a year to a cash balance plan, on top of maxing out their 401(k).

These plans are especially beneficial for individuals who are looking to catch up on retirement savings or who have fluctuating income. By allowing large, tax-deferred contributions, cash balance plans can help in lowering current taxable income while building a substantial retirement nest egg.

Note: The IRS caps the total lifetime benefit you can accumulate in the plan, which is $3.5 million as of 2025.

- Backdoor Roth IRA: High-income earners who exceed $165,000 ($246,000 for those filing jointly) can bypass the Roth IRA income limit by using a backdoor Roth IRA strategy. This involves contributing to a traditional IRA and then converting the funds from the traditional IRA to a Roth IRA. The conversion is a taxable event, with income taxes owed on any pretax contributions and investment earnings in the traditional IRA at the time of conversion. However, once the funds are in the Roth IRA, they can grow tax free and can be withdrawn tax free in retirement. This strategy helps prevent high earners from facing large taxable withdrawals later in life.

- Mega Backdoor Roth: While the backdoor Roth IRA is a great way to get money into a Roth account despite income limits, there’s another strategy called the mega backdoor Roth that can help you contribute even more—potentially tens of thousands more each year. The mega backdoor Roth works through certain 401(k) plans. You make after-tax contributions beyond the usual limit, then move that money into a Roth account inside your plan or roll it over to a Roth IRA. In 2025, this can let you contribute up to $70,000 total. Earnings on the after-tax contributions are taxable when you roll the money over (but not after it’s in the Roth), so make sure not to delay that step.

Not every 401(k) plan allows this, so it’s important to check your plan details or talk to a tax professional to see if it’s an option for you.

2. Investment Tax Strategies

Successful investment tax planning involves a combination of approaches that manage when you pay taxes, how much you pay, and where your investments are held. The following strategies help address these key areas to help maximize your after-tax returns.

Buy-and-Hold Investing

Avoiding frequent trading helps minimize capital gains taxes. When investments appreciate in value, no tax is due until you sell. By holding investments long term, you:

- Defer taxes, allowing more of your money to stay invested and compound over time.

- Qualify for lower long-term capital gains rates (0%, 15%, or 20%, depending on income), instead of higher short-term rates.

- Pass appreciated assets to heirs with a stepped-up cost basis, effectively eliminating capital gains taxes on the appreciation accrued during your lifetime and significantly lowering their tax burden

Tax-Loss Harvesting

This strategy involves selling investments at a loss to offset capital gains. For example, if you realize $50,000 in capital gains but also sell underperforming investments for a $30,000 loss, you’ll only be taxed on the $20,000 difference.

Beyond offsetting gains, you can use up to $3,000 in capital losses annually to offset ordinary income, with additional losses carried forward to future years.

Asset Location Optimization

Strategic placement of investments across taxable and tax-advantaged accounts can minimize overall taxes:

- Keep tax-inefficient investments like bonds and REITs in tax-advantaged accounts such as IRAs or 401(k)s to avoid high taxes on interest and dividends.

- Hold tax-efficient investments such as long-term stock holdings in taxable accounts where they are subject to lower capital gains tax rates if sold.

3. Health Savings Accounts (HSAs)

HSAs are among the few accounts that provide a triple tax advantage—your contributions are tax deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses. This makes them one of the most tax-efficient tools for healthcare savings and long-term financial planning.

By saving with an HSA and letting funds grow tax free, you’ll have a valuable resource to cover medical costs in retirement, one of the largest expenses for aging individuals. However, to be eligible to contribute, you must be enrolled in a high-deductible health plan (HDHP).

For 2025, you can contribute up to:

- $4,300 if your health plan covers only you

- $8,550 if your plan covers your family

- An extra $1,000 as a catch-up contribution if you’re 55 or older

4. Strategic Deductions: Personal and Business Approaches

High-income earners can significantly reduce their tax liability by taking full advantage of both personal and business deductions. Whether you’re a salaried professional or a business owner, understanding which expenses are deductible and how to structure your finances to maximize those deductions can make a substantial difference.

Itemizing Personal Deductions

For individuals, itemizing may offer greater savings than taking the standard deduction ($15,000 for singles and $30,000 for married couples), especially when total deductible expenses exceed these thresholds. The higher your deductions, the more you can reduce your taxable income. Consider the following:

- Medical and dental expenses exceeding 7.5% of your income can be deducted, including out-of-pocket medical costs, prescriptions, dental work, and long-term care premiums (subject to limits).

- State and local taxes (SALT) are deductible up to $10,000 for state income taxes, property taxes, or sales taxes, which can be especially valuable for those in high-tax areas.

- Mortgage interest is deductible on debt up to $750,000 ($1 million for mortgages before December 15, 2017) for both a primary residence and one vacation home can be deducted, which is significant for homeowners with large mortgage payments.

- Donating to qualified charities not only supports causes you care about, but also reduces your taxable income.

Maximizing Business Deductions

For entrepreneurs and other self-employed individuals, strategic use of business deductions can reduce taxable income:

- Home Office Deduction: Available to those who regularly and exclusively use a portion of their home for business.

- Travel and Meals: Business-related airfare, hotels, and 50% of meals are deductible when the funds are spent for client meetings or conferences.

- Vehicle Expenses: Deduct actual expenses or use the IRS mileage rate.

- Health Insurance Premiums: Self-employed individuals may deduct premiums for themselves and their families.

- Technology and Equipment: Deduct or depreciate computers, software, and tools used in the business. Section 179 and bonus depreciation may allow immediate expensing of larger expenses.

Choosing the Right Business Structure

Your entity type also affects your tax profile:

- S-Corporation: This structure allows business income to pass through to the individual’s tax return while potentially lowering self-employment taxes via distributions. Distributions for multi-owner businesses must be pro-rata based on ownership.

- C-Corporation: The flat 21% corporate tax rate is appealing for retained earnings, though dividends face double taxation.

- LLC: Business income also passes through to the individual’s tax return. An LLC offers flexible taxation—either as a sole proprietorship, a partnership, or an S-Corp. Partnership taxation allows a more flexible distribution structure than an S-Corporation.

- S-Corp, Sole Proprietorship, and LLC: These offer potential eligibility for the 20% qualified business income (QBI) deduction on net profits. There are definite strategies for maximizing this deduction that differ based on your form of entity.

5. Real Estate Investment Strategies

Real estate investments offer multiple tax advantages for high-income earners.

Depreciation Benefits

One key advantage is depreciation. The IRS allows property owners to deduct the gradual wear and tear of their buildings (but not land!) over time—27.5 years for residential properties and 39 years for commercial properties. Although this is a noncash expense, it can generate “paper losses” that reduce taxable rental income and, in some cases, offset other types of income as well. This can significantly lower your overall tax liability without reducing actual cash flow. It is important to note that unless you are a real estate professional, real estate investment losses are considered passive and rarely result in a tax return deduction for a high-income earner. The benefits of depreciation for high-income individuals come from a reduction in taxable income in the current year or when you sell the property.

Cost Segregation Studies

A cost segregation study breaks down a property’s components to identify assets that qualify for accelerated depreciation over shorter periods (typically 5, 7, or 15 years) instead of the standard 27.5 or 39 years. This strategy allows property owners to front-load depreciation deductions, generating substantial tax savings during the early years of ownership.

1031 Exchanges

When selling investment property, a 1031 exchange allows you to defer capital gains taxes by reinvesting the proceeds into a similar property. This strategy enables continuous property upgrades while deferring taxes indefinitely. In order for this strategy to work, you cannot have access to any of the cash from the property sale, so this is not ideal if you want or need to pull cash from the investment.

Opportunity Zone Investments

By investing capital gains from the sale of assets into a qualified opportunity fund (QOF), you can defer taxes on those gains until December 31, 2026. Additionally, if you hold the investment for at least 10 years, any new gains from that investment can be exempt from capital gains tax.

Real Estate Professional Status

If you qualify as a real estate professional (spending 750+ hours annually in real estate activities), you may be able to deduct unlimited passive losses from your real estate investments against your ordinary income.

6. Charitable Giving Strategies

Charitable giving isn’t just about generosity—it can also be a powerful financial strategy to reduce taxable income.

Donor-Advised Funds (DAFs)

A donor-advised fund enables individuals to make a large charitable contribution in a single year, generating an immediate tax deduction, while granting the funds to charities gradually over time. This strategy helps surpass the standard deduction by consolidating multiple years of giving into one tax year, maximizing savings—especially during a high-income year.

Charitable Remainder Trusts (CRTs)

Similar to a DAF, a charitable remainder trust allows you to support a charitable cause and generate immediate tax savings, but unlike a DAF, it also provides you with income from your assets. You transfer appreciated assets like stocks, real estate, or land into the trust. The trust then sells those assets tax-free and reinvests the proceeds. In return, it pays you (or a beneficiary you choose) a steady income, typically a fixed percentage of the trust’s value, for life or a set number of years. After the trust term ends, the remaining assets go to the charity you’ve chosen.

This strategy offers multiple benefits: It can reduce your taxes, avoid immediate capital gains on appreciated assets, and provide a steady income stream, all while supporting a cause you care about.

7. Estate Planning Strategies with Tax Benefits

Estate planning can play a key role in reducing taxes over your lifetime, with some of the greatest benefits often realized in retirement. The following strategies help transfer wealth efficiently while offering meaningful tax benefits for both you and your heirs.

Lifetime Gifting

In 2025, you can give up to $19,000 per recipient, or $38,000 for married couples, each year without using your lifetime gift tax exemption, helping reduce your taxable estate while supporting loved ones.

Grantor Retained Annuity Trusts (GRATs)

A grantor retained annuity trust is an advanced estate planning strategy often used by high-net-worth individuals to transfer appreciating assets to beneficiaries, with minimal or no gift tax. You transfer assets to the trust and receive fixed annuity payments for a set number of years. At the end of the term, any remaining value, typically the appreciation beyond a hurdle rate set by the IRS (known as the Section 7520 rate), passes to your beneficiaries free of additional gift tax.

GRATs work best when the trust’s assets significantly outperform the IRS interest rate, allowing the excess growth to transfer to heirs tax-efficiently. They are often used to shift wealth while minimizing the use of your lifetime gift and estate tax exemption.

However, one key risk with a GRAT is that the grantor must survive the full term of the trust for it to achieve its intended tax benefits. If the grantor passes away during the annuity period, the remaining trust assets, including any appreciation, are typically pulled back into the grantor’s estate and subject to estate tax. This risk makes GRATs most effective when the grantor is in good health and the trust term is kept relatively short.

8. Other Tax-Advantaged Investments

Municipal Bonds

Municipal bonds, often called “munis,” offer a unique tax advantage: The interest they generate is generally exempt from federal income tax and may also be exempt from state and local taxes if you live in the issuing state.

Although municipal bonds usually pay less interest than regular taxable bonds, the money you earn from them isn’t taxed at the federal level—and sometimes not at the state or local level either. Because of this tax break, the actual amount of money you keep (after taxes) can be more with municipal bonds than with higher-paying taxable bonds. This benefit is especially important for people who are in higher tax brackets, as they would otherwise pay more in taxes on regular bond interest.

It is important to compare the rate of return on your muni bonds to the after-tax rate of return on your alternative investment to decide whether muni bonds make sense for you.

Treasury Securities

U.S. Treasury securities are backed by the full faith and credit of the federal government, making them one of the safest investment options available. A key benefit is that the interest earned is exempt from state and local income taxes—a valuable feature for investors in high-tax states.

Here are the main types to consider:

- Treasury Bills (T-Bills): Short-term securities that mature in one year or less. Sold at a discount and pay no interest until maturity.

- Treasury Notes: Medium-term investments with maturities of 2 to 10 years, offering semiannual interest payments.

- Treasury Bonds: Long-term options with 20- or 30-year maturities, paying interest every six months.

- Treasury Inflation-Protected Securities (TIPS): Designed to protect against inflation. The principal adjusts with inflation, and interest is paid twice a year based on the adjusted amount.

Deferred Compensation Plans

High-income earners, particularly executives, may have access to deferred compensation plans, which allow them to delay receiving part of their income until a later year, often in retirement, when they may be in a lower tax bracket. These plans come in two broad types: qualified (like 401(k)s) and nonqualified. This section focuses on nonqualified deferred compensation (NQDC) plans, which offer greater flexibility but also involve more risk.

Key benefits of NQDC plans:

- Immediate tax deferral: Lower your current taxable income.

- Tax bracket arbitrage: Withdraw income later, when you’re in a lower tax bracket.

- Flexible distributions: Choose lump sums or installments to suit retirement cash flow needs.

- State tax planning: Defer income until after moving to a lower- or no-tax state.

- Beyond IRS limits: Save more than what’s allowed in qualified retirement plans.

Risks to consider:

- Creditor risk: Deferred income remains the company’s asset until paid; if the employer goes bankrupt, your money may be at risk.

- Irrevocable elections: Once you choose to defer, you typically can’t change your mind.

- Complex rules: Plans must follow strict timing and distribution regulations (IRC Section 409A).

NQDC plans are powerful tools for tax planning and wealth preservation, but they require careful evaluation—especially around the employer’s financial health and your long-term goals.

9. Tax-Efficient Education Funding

529 College Savings Plans

College can be a large expense, even for those who are high earners, but utilizing a 529 plan is one of the most effective ways to save for education while gaining valuable tax and estate planning benefits. Contributions grow tax-deferred, and withdrawals used for qualified education expenses, like tuition, books, room, and board, are tax-free.

Many states offer an income tax deduction or credit for contributions to their own plans, giving you an immediate benefit. Funds can be used for college, K–12 tuition (up to $10,000/year), student loan repayment (up to $10,000 total), and even vocational programs. If one beneficiary doesn’t use the funds, you can easily transfer the account to another family member.

For high-net-worth individuals, a 529 also serves as a smart estate planning tool. You can “superfund” the account by bundling up to five years’ worth of annual gifts into a single contribution of up to $95,000 ($190,000 for couples) per beneficiary. This removes the amount from your taxable estate and accelerates your gifting strategy without triggering gift taxes, all while retaining control over how the money is used.

Make sure you set up the plan for a beneficiary younger than you. If you first set up the plan in your name and then transfer it to a beneficiary, you have reduced the legacy benefit of the plan. Transfers to more than two generations down from the original beneficiary are subject to gift and generation-skipping taxes.

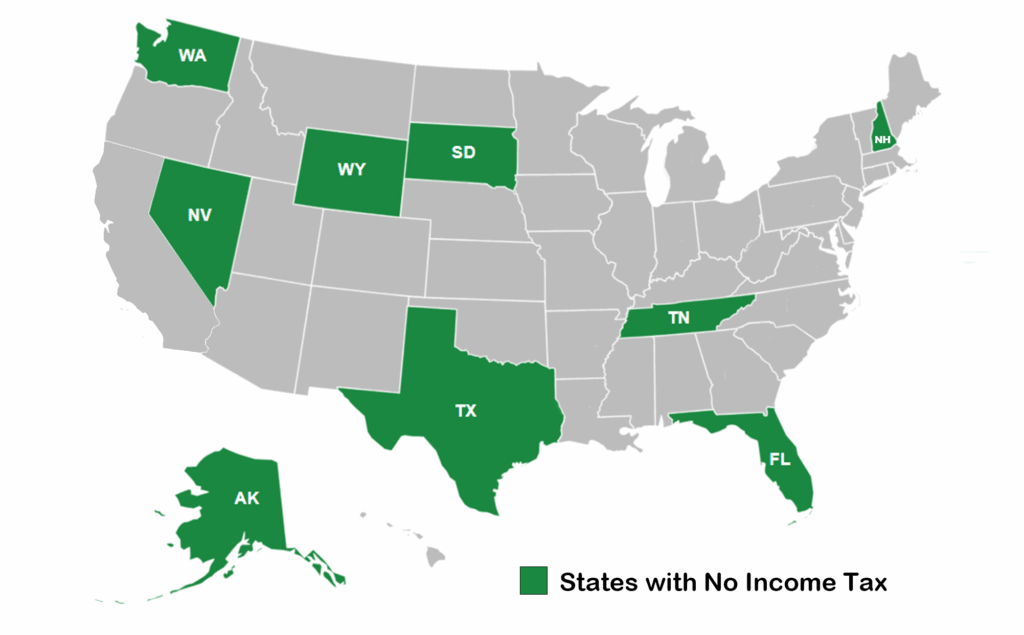

10. State Tax Planning

Domicile Planning

For high-income earners with flexibility, such as remote workers, frequent travelers, or those planning a move, establishing residency in a low- or no-income-tax state can lead to significant long-term savings. States without income tax are:

| Alaska | Florida | Texas | Tennessee | New Hampshire | Nevada | Wyoming | Washington | South Dakota |

|---|

However, simply owning property in a low-tax state isn’t enough. Changing your domicile requires careful documentation and a genuine relocation—including spending the majority of your time there, updating legal and financial records, and demonstrating true intent to make it your permanent home.

Developing a High-Income Tax Strategy to Reduce Taxable Income

As a high-income earner, an effective tax strategy requires:

- Integration: Coordinating income, investments, retirement, business, and estate planning

- Personalization: Tailoring strategies to your specific goals and risk tolerance

- Proactive Planning: Acting before year-end, not just at tax time

- Regular Review: Adjusting as laws, circumstances, and markets change

- Experienced Guidance: Working with advisors who understand the complexities high earners face and the common pitfalls to avoid

Remember that reducing taxable income is just one aspect of financial planning. The ultimate goal is building and preserving wealth while achieving your personal and financial objectives.

We understand that all of this can be complex, especially when your finances include multiple income sources, investments, and long-term goals. If you need help navigating these complexities and creating a tax strategy tailored to your unique situation, our team is here to assist. Talk to an advisor or call (603) 589-8010 to start building a personalized plan to reduce your tax burden.

All mentioned limits are effective for the 2025 tax year.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.