Whenever economic uncertainty or stock market volatility spikes, gold grabs headlines as a safe haven. You can hold its value in your hand, and this precious metal’s value has endured for thousands of years through wars, crises, and upheaval. Yet, for long-term investing, a diversified portfolio of stocks and bonds has consistently outperformed investing in gold.

Gold

Gold is a commodity with intrinsic value — its worth comes from its physical properties and uses, like in jewelry or electronics, as well as from purchases by individual investors and governments. As with any commodity, its price hinges on supply and demand. This makes gold prone to sharp price swings based on short-term market sentiment. If demand drops, you can only sell for what someone’s willing to pay.

Stock prices reflect a company’s future earnings potential, while gold prices are driven purely by supply and demand. Gold doesn’t generate income. There are no dividends, no interest, and no underlying growth. That makes gold a speculative asset: you’re not investing in something that creates value, you’re betting that someone will pay more for it later. Gold’s appeal often surges during fear-driven narratives — economic collapse, currency devaluation, or geopolitical chaos. But these events are rare and fleeting.

Liquidity — how easily an asset converts to cash — is another hurdle. On April 16, 2025, the S&P 500 had a volume of 3.34 billion. This massive market of buyers and sellers narrows the bid-ask spread — the gap between what buyers offer and sellers accept, which acts as a transaction cost. Now imagine trading 3.34 billion gold bars daily — it’s impractical. Gold’s smaller market means higher transaction costs and less liquidity.

To mitigate this, investors can buy gold through exchange-traded funds (ETFs) like GLD instead of buying physical bars. ETFs track gold prices and trade like stocks, offering higher liquidity and no storage hassles. You can buy or sell shares instantly on major exchanges, avoiding the logistics of handling gold.

A diversified portfolio promotes discipline, tapping into global economic growth and cushioning losses with bonds during downturns. Gold, however, can lure investors into speculation, chasing price spikes or hoarding for doomsday scenarios that seldom happen. Gold is popular now, but this popularity could fade at any time.

Stock Market Investments

Stock prices are derived from external factors like company performance, projected earnings, market conditions, and investor sentiment. Stock prices rise when companies grow by creating new products, improving efficiency, and boosting profits. This innovation drives economic progress.

When you buy stocks, you’re investing in real companies — people working to produce goods and services that benefit society. Profitable companies reinvest earnings to grow or pay dividends — cash bonuses to shareholders based on shares owned. Dividends aren’t guaranteed, but they reward investors for backing a company’s success. Gold, by contrast, generates no income and has no valuable future earning potential.

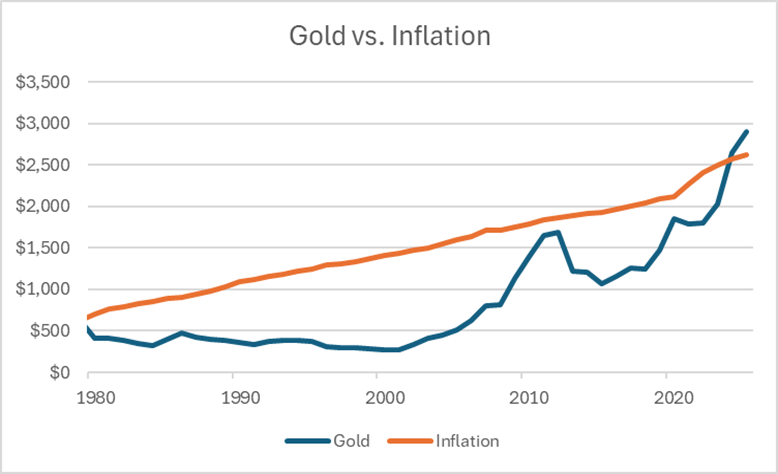

Investment Return: Gold vs. Inflation

A critical metric is how an investment performs against inflation — the rising cost of living. For example, $100 in 1980 is equivalent to $388 today due to inflation. Ideally, investments should outpace inflation over time. Cash, CDs, and savings accounts often lag inflation, making them suitable for short-term needs. Stocks, however, are designed for long-term growth.

Gold’s track record is less impressive. Before 1971, U.S. gold prices were fixed under the gold standard. After President Nixon ended dollar-to-gold convertibility, gold prices surged, hitting $615 per ounce by 1980. But how has gold fared against inflation since?

Below is a line graph comparing gold prices and the Consumer Price Index (CPI) from 1980 to 2025. The CPI steadily rises, reflecting inflation’s consistent climb. Gold prices spike in the early 1980s, dip through the 1990s, surge in the 2000s, and fluctuate recently, often lagging the CPI over the long term, and ending just over where the CPI is is today.1

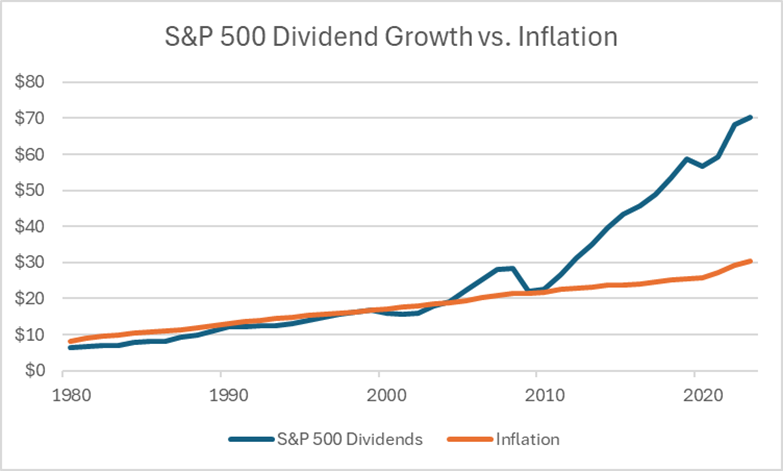

Income: Gold vs. Stocks

Gold produces no income. Returns depend entirely on price appreciation, and holding gold means missing out on income-generating assets like stocks or bonds. This is called an opportunity cost.

Not only do stocks earn dividends, but the rate of growth of those dividends grows over time at a much faster rate than inflation.2 The annual dividends paid on one share of the S&P 500 were about $6 in 1980 and are about $75 today. Why would you purchase a stagnant lump of gold over a share of stock that pays out an ever-rising stream of income?

The below chart shows the growth of the dividends paid on one share of the S&P 500 over time and inflation as measured by the CPI. Starting in 2010, dividend growth far outpaced inflation.

Diversification

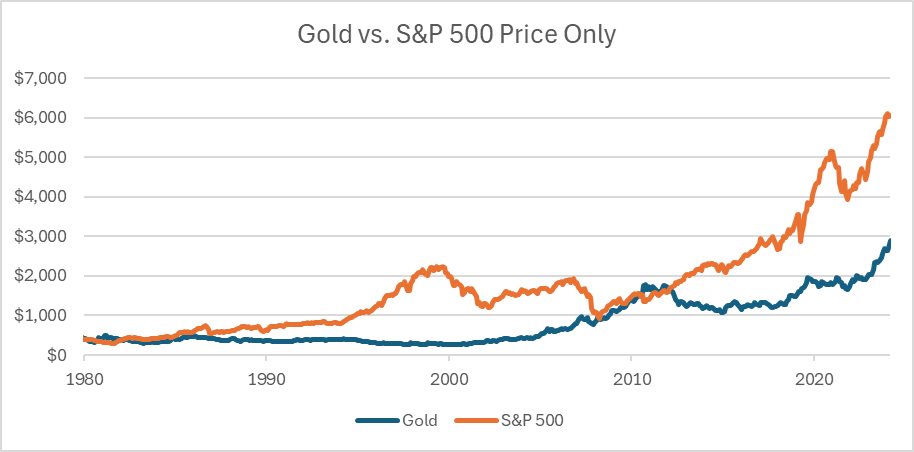

Is gold a good diversifier? It’s often touted as a hedge against inflation, but its benefits are limited. Gold prices are driven by sentiment, not economic fundamentals. From 1980 to 2000, gold stagnated while stocks soared. Worse, gold’s correlation with stocks can turn positive during crises, weakening its hedge value.

We recommend diversified portfolios including growth stocks, value stocks, small-cap U.S. stocks, international stocks, emerging markets, and real estate investment trusts (REITs). Before adding an asset like gold, ensure it offers long-term positive returns. Gold falls short as an inflation hedge and lags stocks in both price growth and ongoing income.

The chart below shows the price of gold and the S&P 500 from 1980 until now. Keep in mind the S&P 500 amounts do not include dividends, which only increase its value. Please remember that past performance does not predict future results.

Gold is also a very concentrated asset class (similar to silver, timber, wheat, etc.). If a large supply of gold is discovered or a new technology is developed that increases the supply, the value may fall dramatically. Gold involves a large concentration risk.

Taxes

Gold is taxed as a collectible, with long-term capital gains taxed at 28% for investors with ordinary income above that marginal rate. Stocks, however, benefit from lower rates — 15% or 20% for long-term capital gains and qualified dividends, depending on income.3 After-tax returns matter, and stocks’ higher growth and lower taxes make them the clear winner. A possible 86% higher tax rate on gold isn’t enticing.4 Selling gold outside a retirement account can be expensive.

Conclusion

Gold’s allure is undeniable — it’s tangible and historic, and it shines in times of fear. But as an investment, it pales against a diversified portfolio of stocks and bonds. Gold offers no income, and it has just kept up with inflation over the long term. Its price swings are driven by sentiment, not fundamentals, and its tax treatment is much higher. A diversified portfolio, by contrast, harnesses the growth of global economies, generates income, and mitigates risk through varied assets. For most investors, gold is a bad investment for building long-term wealth. It’s more of a speculative bet than a cornerstone of a solid investment strategy. Focus on stocks and bonds for long-term growth, and let gold stay in the headlines.

Past performance does not predict future results. Your circumstances are unique to you. Make sure you discuss your situation with a qualified financial advisor before taking action. If you need assistance with your overall financial plan, we encourage you to reach out to our team.

[1] Prices charted as of 12/31 of the year mentioned. Common starting point for comparability.

[2] CPI/10 used for comparability.

[3] Yes, technically there is an additional 3.8% Medicare tax if you are high income and have a lot of non-earned income, but that is the same tax regardless of whether the income is from the sale of a collectible or the sale of stocks, so we ignored it for this discussion.

[4] (28% – 15%) = 13%/15% = 86% higher tax rate at its worst.

Disclaimer: This is not to be considered investment, tax, or financial advice. Please review your personal situation with your tax and/or financial advisor. Milestone Financial Planning, LLC (Milestone) is a fee-only financial planning firm and registered investment advisor in Bedford, NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services and have unlimited access to our advisors. We receive no commissions or referral fees. We put our client’s interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors. Advisory services are only offered to clients or prospective clients where Milestone and its representatives are properly licensed or exempt from licensure. Past performance shown is not indicative of future results, which could differ substantially.